XRP’s Meteoric Rise: Can It Smash New All-Time Highs in 2025?

A Surge to Remember

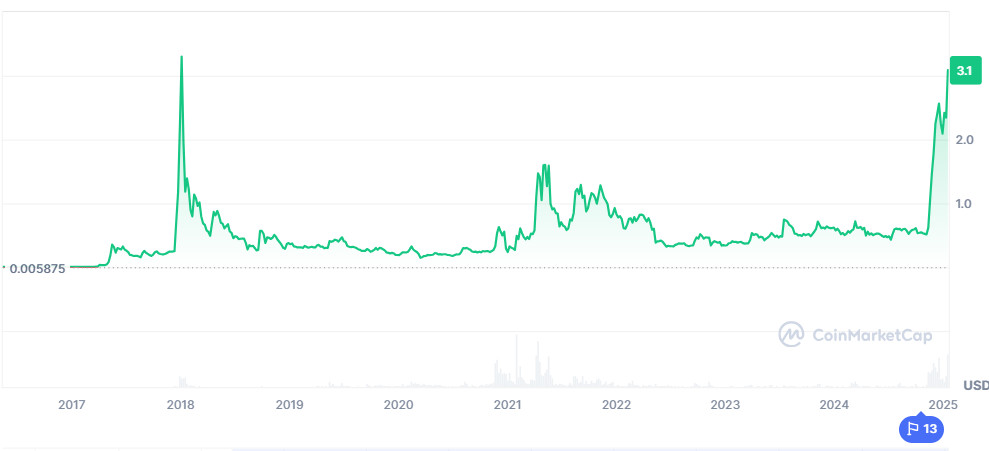

XRP just made waves in the crypto world, hitting its highest valuation since January 2018. Even an ongoing legal tug-of-war with the U.S. Securities and Exchange Commission (SEC) couldn’t dampen the token’s momentum. Instead, optimism about upcoming crypto regulations seems to be fueling its rally, catching the attention of both retail and institutional investors.

As of January 15, XRP soared to $3.20, before slightly pulling back to trade at $3.09 the next day. That’s a staggering 32% weekly gain, according to CoinMarketCap.

XRP Price Chart

XRP Price Chart

XRP/USDT, all-time chart. Source: CoinMarketCap

While the SEC’s latest legal maneuver—an appeal filed on January 15 to classify XRP’s retail sales as securities—might have raised concerns, the market seemed unfazed. Instead, investor confidence remains strong, driven by Ripple’s partial victories in the lawsuit and a broader expectation for regulatory clarity in the U.S.

Regulatory Hopes Drive Market Sentiment

According to Ryan Lee, chief analyst at Bitget Research, Ripple’s legal successes and a shift toward crypto-friendly policies in the U.S. are the key factors behind XRP’s impressive surge.

“XRP’s surge can be attributed to favorable outcomes in Ripple’s SEC lawsuit and a more crypto-friendly political climate in the US. If regulatory uncertainties are resolved, the influx of institutional investors could further solidify XRP’s position in the crypto market.”

RippleNet’s expanding adoption is also adding fuel to the fire, strengthening XRP’s appeal among institutional players.

XRP ETFs: The Next Big Catalyst for 2025?

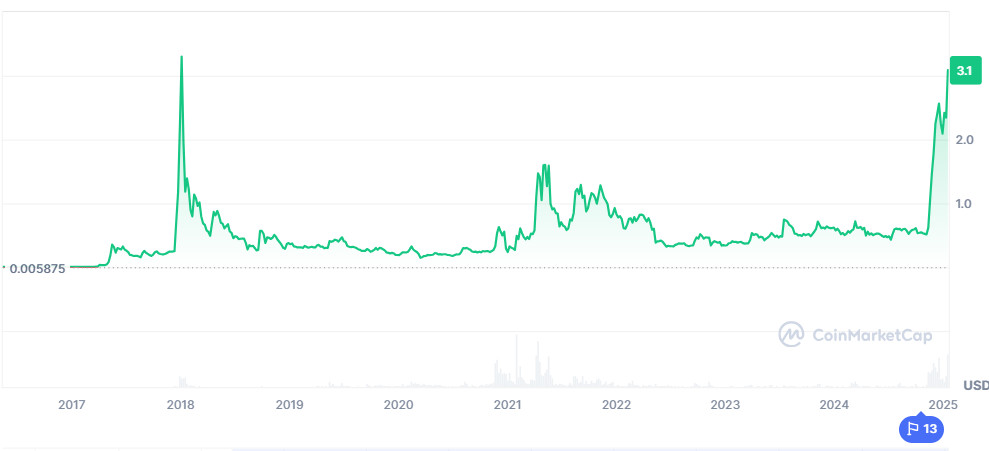

With a new U.S. administration set to take office, speculation is growing about the potential approval of the first spot XRP ETFs (Exchange-Traded Funds)—which could be a game-changer.

XRP ETF Forecast

XRP ETF Forecast

SOL and XRP ETPs could attract $3–8 billion. Source: JP Morgan

If approved, these ETFs could attract between $3 billion to $6 billion in net new investments, based on JPMorgan’s estimates, mirroring the trend seen with Ether ETFs.

Several major asset managers, including VanEck, Grayscale, 21Shares, Bitwise, and Canary Capital, have already applied for Solana ETFs. Given the SEC’s decisions on these applications are due by the end of January, XRP ETFs may not be far behind.

Could XRP Break the $14 Barrier?

One of the biggest questions for 2025 is whether XRP could hit double digits. Recent bullish signals suggest it’s not out of the realm of possibility.

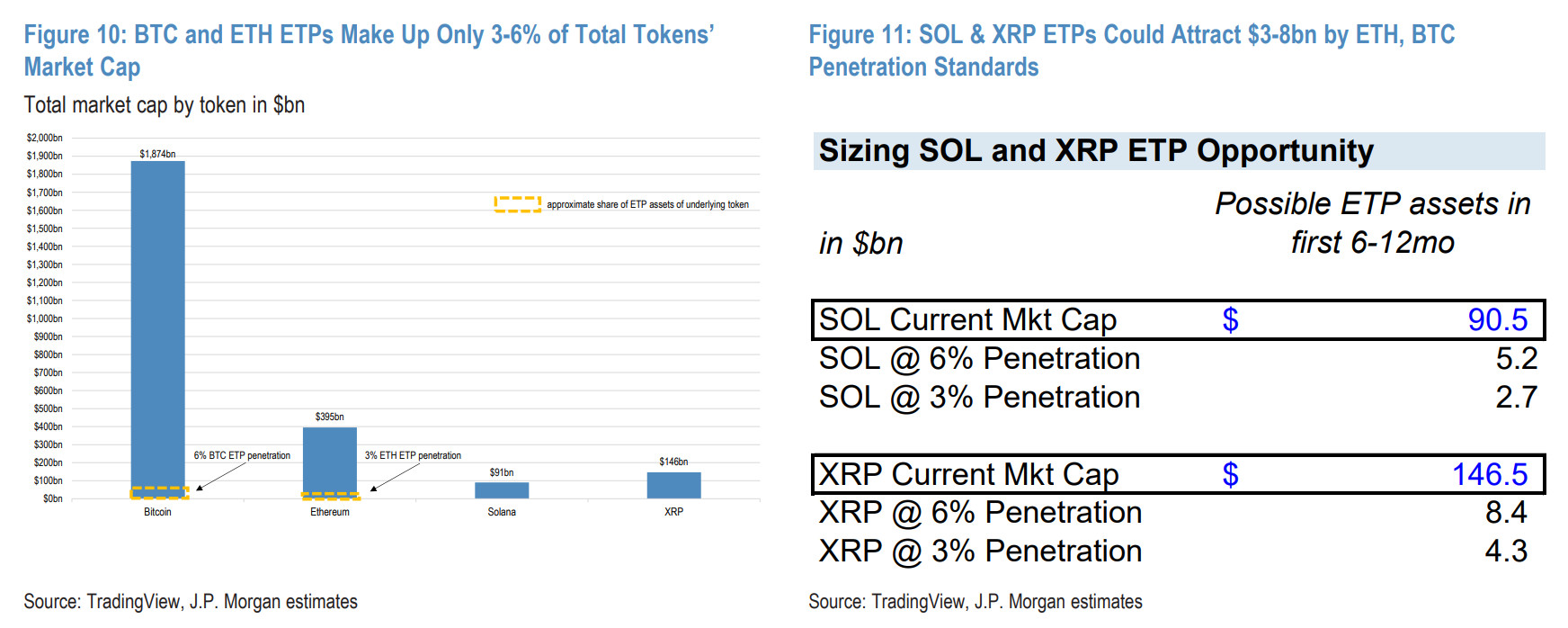

Crypto analyst Steph Is Crypto predicts a potential surge to $14, citing a bullish pennant formation in XRP’s daily chart.

“XRP successfully retested the breakout point. Bullish target: $14. Conservative target: $5.”

XRP Bullish Pennant

XRP Bullish Pennant

XRP/USD, 1-day chart. Bullish pennant. Source: Steph Is Crypto

A bullish pennant is a classic technical indicator that can signify the continuation of an existing rally. If XRP sustains its upward momentum and breaks through key resistance levels, a historic price run could be on the horizon.

Final Thoughts

With legal headwinds easing, increased institutional interest, and a potential ETF approval looming, XRP is riding a wave of optimism. While nothing in crypto is ever guaranteed, the stars may finally be aligning for XRP’s biggest breakout yet.

Could 2025 be the year XRP reaches new all-time highs? Time will tell, but investors are certainly watching closely. 🚀