The Future of Stablecoins: A Game-Changer for the US Dollar

As the world of digital assets continues to evolve, stablecoins are emerging as a pivotal force in financial markets. The US government is taking swift action to ensure the dollar maintains its dominance in this space. According to Bo Hines, Executive Director of the President’s Council of Advisers on Digital Assets, a comprehensive stablecoin bill could soon be on the president’s desk—a move that could redefine the US economy’s digital footprint.

A Major Step Toward Stablecoin Regulation

On March 18, during the Digital Asset Summit in New York, Hines hinted at the imminent passage of stablecoin legislation, following the Senate Banking Committee’s approval of the GENIUS Act. Standing for Guiding and Establishing National Innovation for US Stablecoins, this bill lays out strict collateralization requirements for stablecoin issuers and enforces compliance with Anti-Money Laundering (AML) laws.

Hines emphasized the bipartisan nature of the vote, underscoring a rare moment of unity in Washington:

“I think our colleagues on the other side of the aisle also recognize the importance for US dominance in this space, and they’re willing to work with us here. There aren’t many issues that bring both sides together like this, which is what makes it so exciting.”

Bo Hines speaking at the Digital Asset Summit

Bo Hines speaking at the Digital Asset Summit

When pressed for a timeline, Hines suggested that stablecoin legislation could land on the president’s desk within the next two months. He also noted that many are underestimating just how impactful this bill could be, particularly in reinforcing US dollar supremacy in onchain transactions and the broader financial ecosystem.

Why Stablecoin Regulation Matters

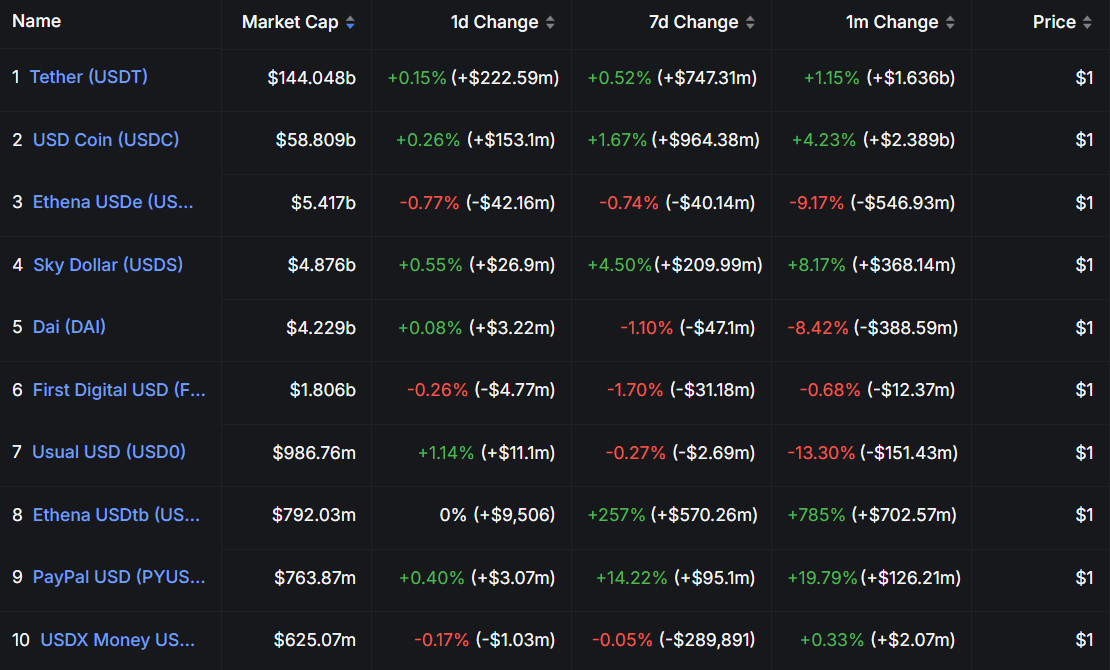

Stablecoins are pegged to traditional currencies, allowing for seamless digital transactions without the volatility of cryptocurrencies like Bitcoin. The US dollar currently backs the vast majority of the $230 billion stablecoin market, reinforcing its stronghold as the world’s default digital currency.

However, as new developments point toward the rise of multi-currency stablecoins, some speculate that the dollar’s dominance may eventually wane.

Dollar-denominated stablecoins continue to dominate DefiLlama

Dollar-denominated stablecoins continue to dominate DefiLlama

The US Government’s Vision for Stablecoins

US Treasury Secretary Scott Bessent has been vocal about using stablecoins as a tool to safeguard the dollar’s status as the world’s reserve currency. Speaking at the White House Crypto Summit on March 7, he made it clear that the administration sees stablecoins as a cornerstone of financial strategy moving forward:

“We are going to put a lot of thought into the stablecoin regime. As President Trump has directed, we will ensure the US dollar remains the dominant reserve currency, and we will use stablecoins to do that.”

Treasury Secretary Scott Bessent with President Trump The Associated Press

Treasury Secretary Scott Bessent with President Trump The Associated Press

With financial institutions closely watching the stablecoin landscape, the coming months could be pivotal for the future of digital payments—and the global standing of the US dollar.

What’s Next?

As regulations tighten and the landscape shifts, one thing is clear: stablecoins are here to stay, and they could solidify the US dollar’s dominance in the digital age. Whether you’re an investor, policymaker, or crypto enthusiast, this upcoming legislation is something you don’t want to ignore.

Related: Banks push to block stablecoin legislation over market share fears