Tether’s Bold Expansion: Doubling Down on Compliance and Growth

A Lean Machine Aiming Higher

Tether, the heavyweight in the stablecoin arena, isn’t just sitting back and enjoying its dominance. The company is making a bold move to double its workforce by mid-2025, with a laser focus on beefing up its compliance team. With regulatory scrutiny tightening and financial crime monitoring becoming a bigger piece of the puzzle, this expansion signals that Tether is taking its responsibilities seriously.

In a recent interview with Bloomberg, Tether’s CEO, Paolo Ardoino, shared insights into the company’s hiring strategy, emphasizing a commitment to a lean, efficient, and highly skilled team.

Precision Over Mass Hiring

Unlike many tech companies that scale rapidly only to slash jobs during downturns, Tether prides itself on a different approach. Ardoino made it clear:

“We are very proud of the fact that we are very lean and we want to remain lean because we want to be flexible. We are very careful when we hire people, we hire only senior people.”

This means strategic hiring, focusing on seasoned professionals who bring expertise and agility to the table.

Strengthening Compliance: A Necessary Move

One of the driving forces behind this expansion is compliance and monitoring. While Tether’s USDT stablecoin enjoys widespread adoption, it has also faced concerns regarding illicit activities in secondary markets.

To stay ahead of the curve, Tether aims to integrate advanced automation tools to track suspicious transactions more efficiently. In an effort to uphold transparency and security, the company recently partnered with blockchain analytics firm, Chainalysis, to enhance its transaction monitoring and sanctions screening capabilities.

Primary vs. Secondary Markets: Why It Matters

- Primary Markets: This is where users buy or redeem USDT directly from Tether.

- Secondary Markets: These include crypto exchanges and OTC trading platforms where users buy and sell USDT among themselves.

Tether’s move suggests a proactive stance in monitoring secondary markets, ensuring that its stablecoin isn’t misused for illicit activities.

A Financial Powerhouse with a Small but Mighty Team

Despite running on a relatively small headcount, Tether continues to shatter financial records. The company reported a staggering $5.2 billion in profit for the first half of 2024, proving that efficiency and profitability can go hand in hand.

“There is nothing that I hate more than all those companies, especially Silicon Valley companies, that hire hundreds of people during the bull runs to fire them as soon as there is a downturn in the market.” — Paolo Ardoino

USDT’s Market Dominance Stays Strong

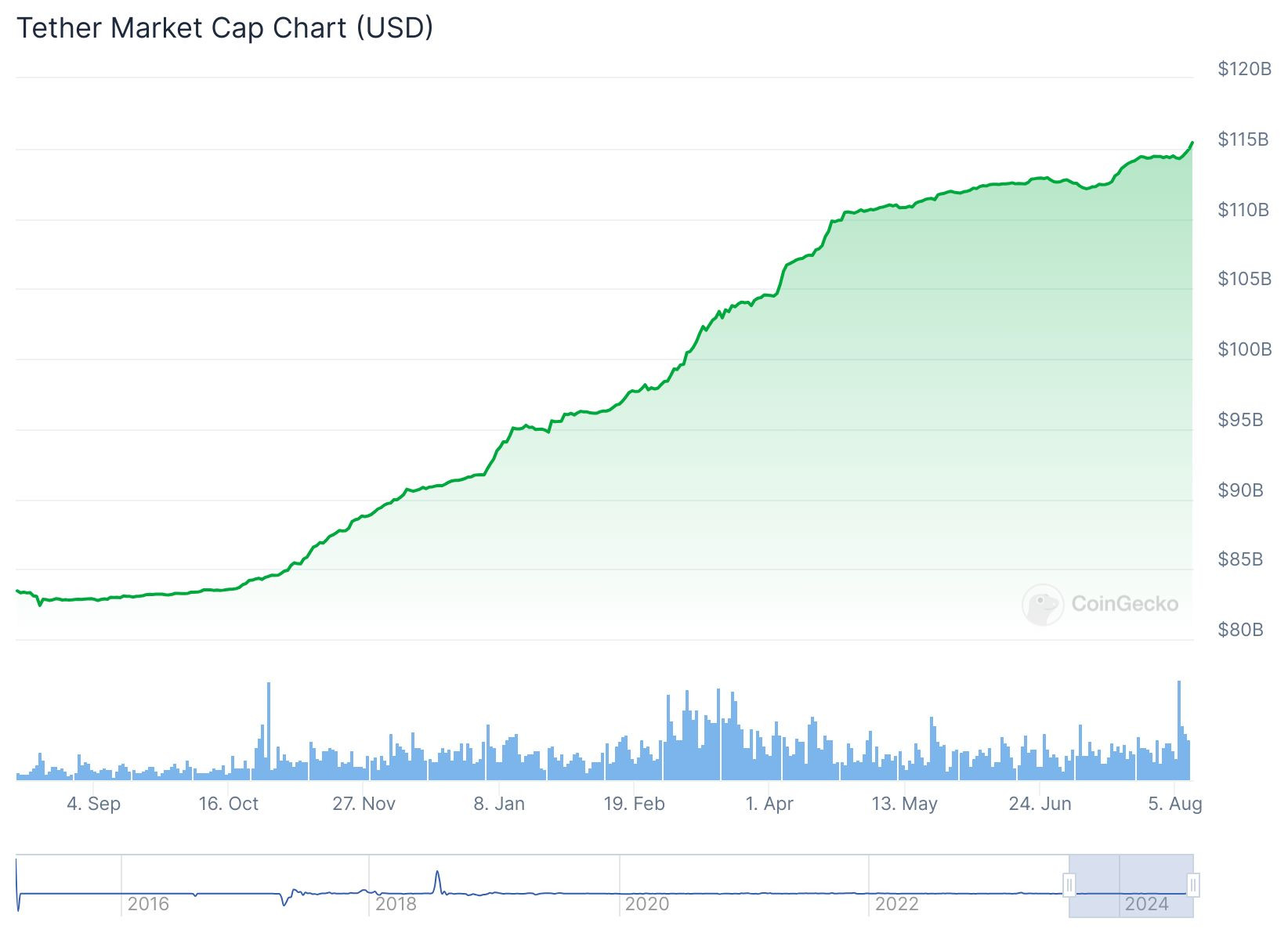

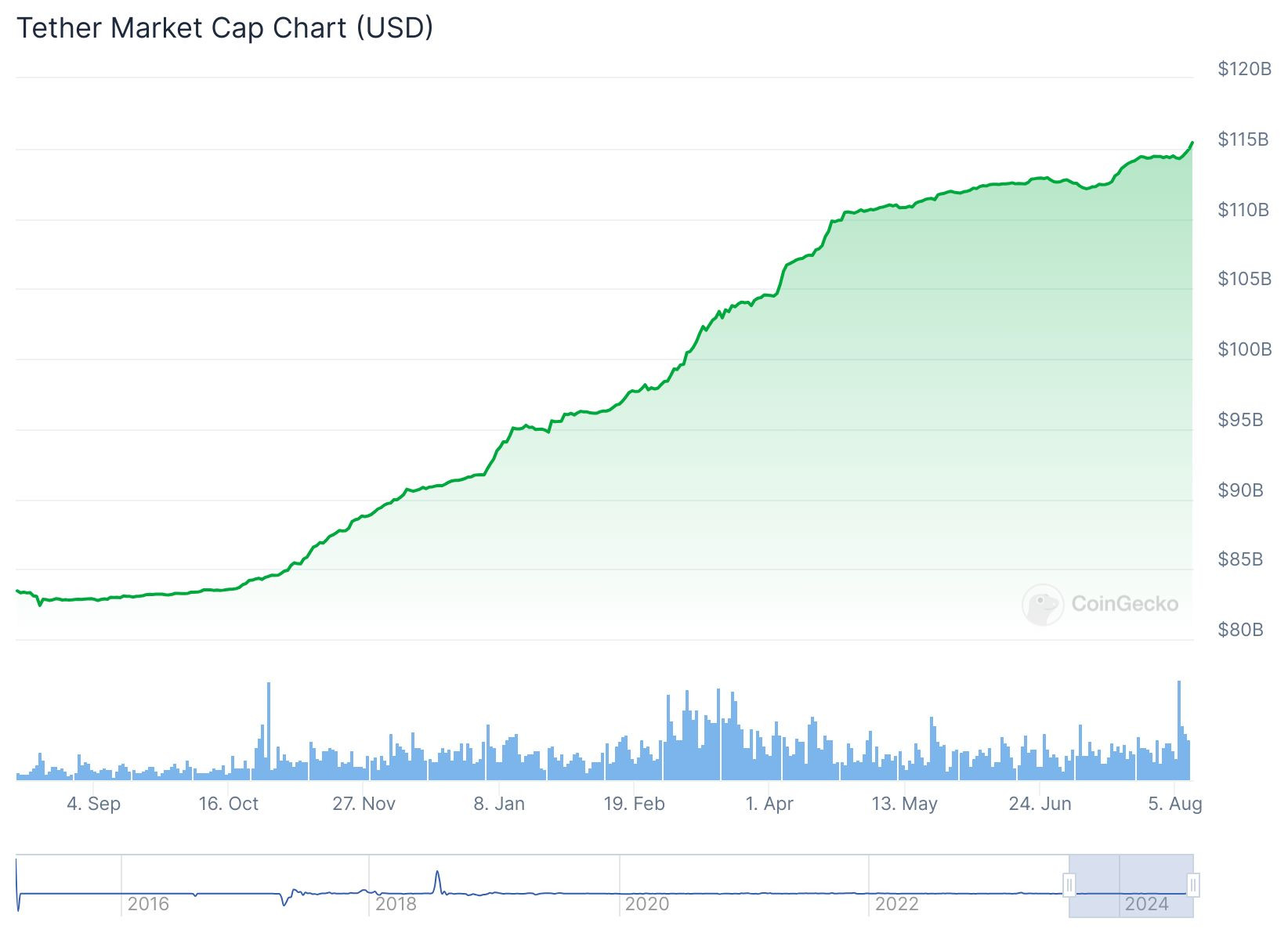

Alongside its internal growth, Tether’s flagship USDT stablecoin continues to expand. Since the start of 2024, its supply has jumped by over 25%, reaching a total circulation of $115 billion. This gives USDT a dominant 70% market share in the stablecoin industry.

For comparison, its closest competitor, Circle’s USDC, has a $34.4 billion supply, making up just 21% of the stablecoin market.

USDT supply growth over the past year. Source: CoinGecko

The Road Ahead

Tether isn’t just stopping at compliance and expansion. Its recent launch of a gold-backed stablecoin, Alloy, signals the company’s ambition to diversify and innovate beyond traditional crypto markets.

As the stablecoin space continues to evolve, Tether’s calculated strategy of selective hiring, regulatory cooperation, and financial strength is positioning it for long-term dominance.

With regulatory landscapes shifting and crypto adoption growing, Tether’s next moves will be closely watched. One thing is certain—this isn’t just about growth; it’s about cementing its place at the forefront of the financial revolution.

📖 Related: Tether launches gold-backed, US dollar stablecoin Alloy

📜 Magazine: How Chinese traders and miners get around China’s crypto ban