The Crypto Boom of 2025: How ETFs and Stablecoins Are Shaping the Future

As we inch closer to 2025, the world of digital assets is gaining unstoppable momentum. A recent Citi report highlights how cryptocurrency exchange-traded funds (ETFs) and stablecoins are acting as major catalysts for this growth, setting the stage for what could be a record-breaking year in crypto adoption. But what’s fueling this surge? Let’s dive into the details.

The Power of Adoption: Why It Matters

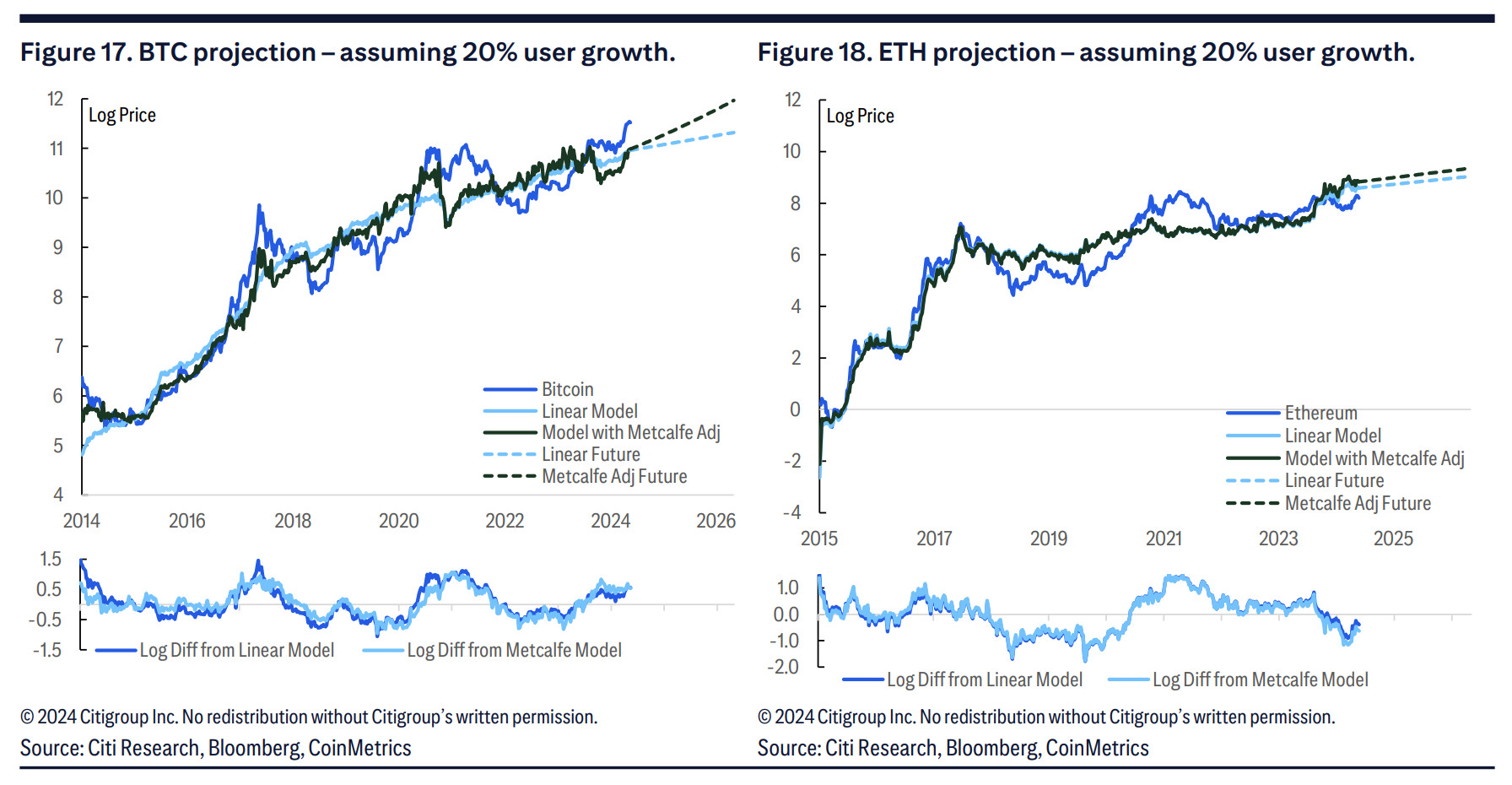

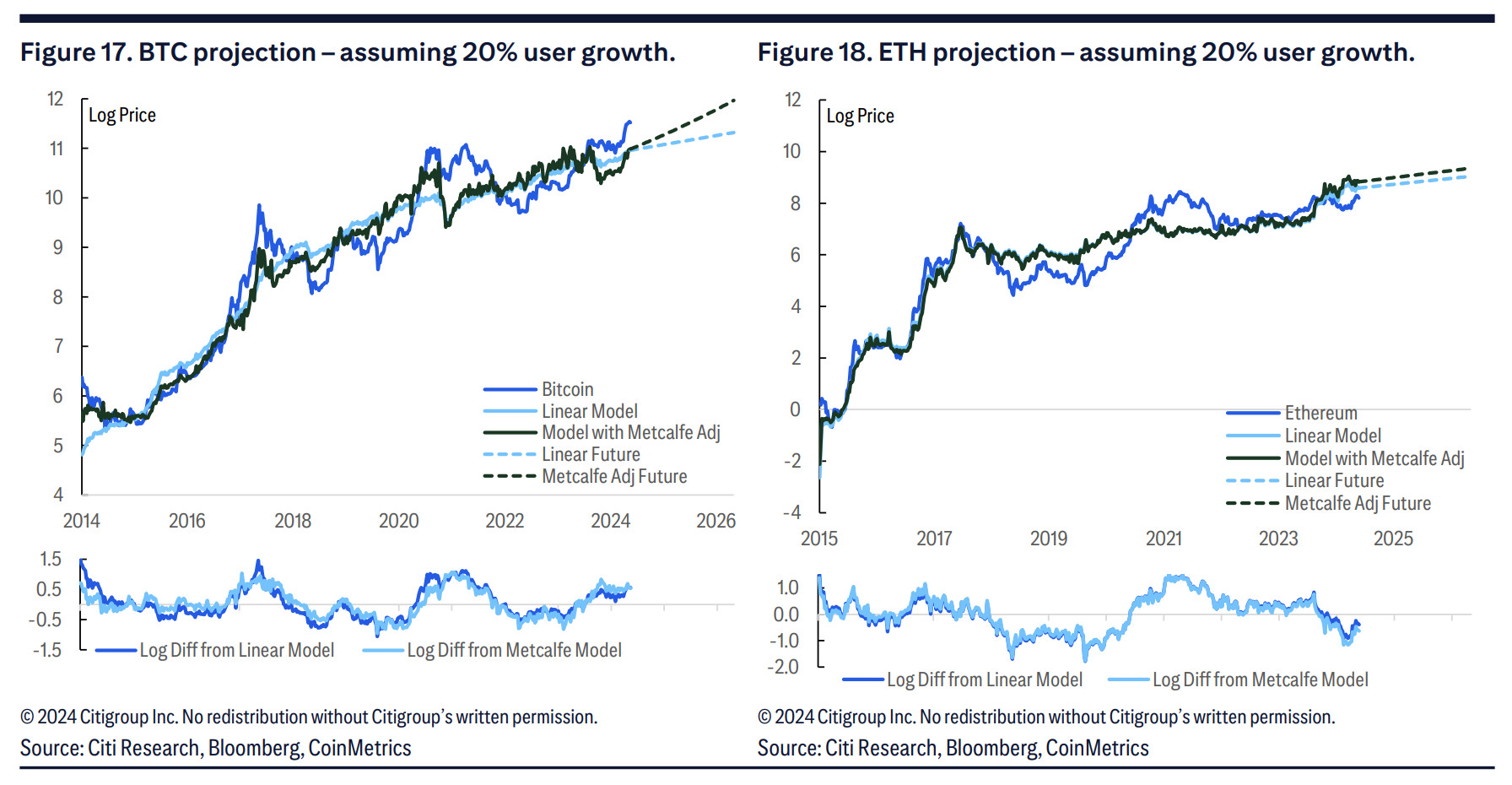

When it comes to crypto’s long-term trajectory, Citi emphasizes that adoption is the key factor to watch. While price swings and hype cycles come and go, persistent growth in ETFs and stablecoin use signals strong market commitment.

“ETF activity and broader volumes are improving, and stablecoin market caps—which we view as a measure of flows into the crypto ecosystem—are swiftly rising (especially post-election).”

This steady rise in investor participation suggests that digital assets are not just a passing trend but an evolving financial cornerstone.

Source: Citi

Source: Citi

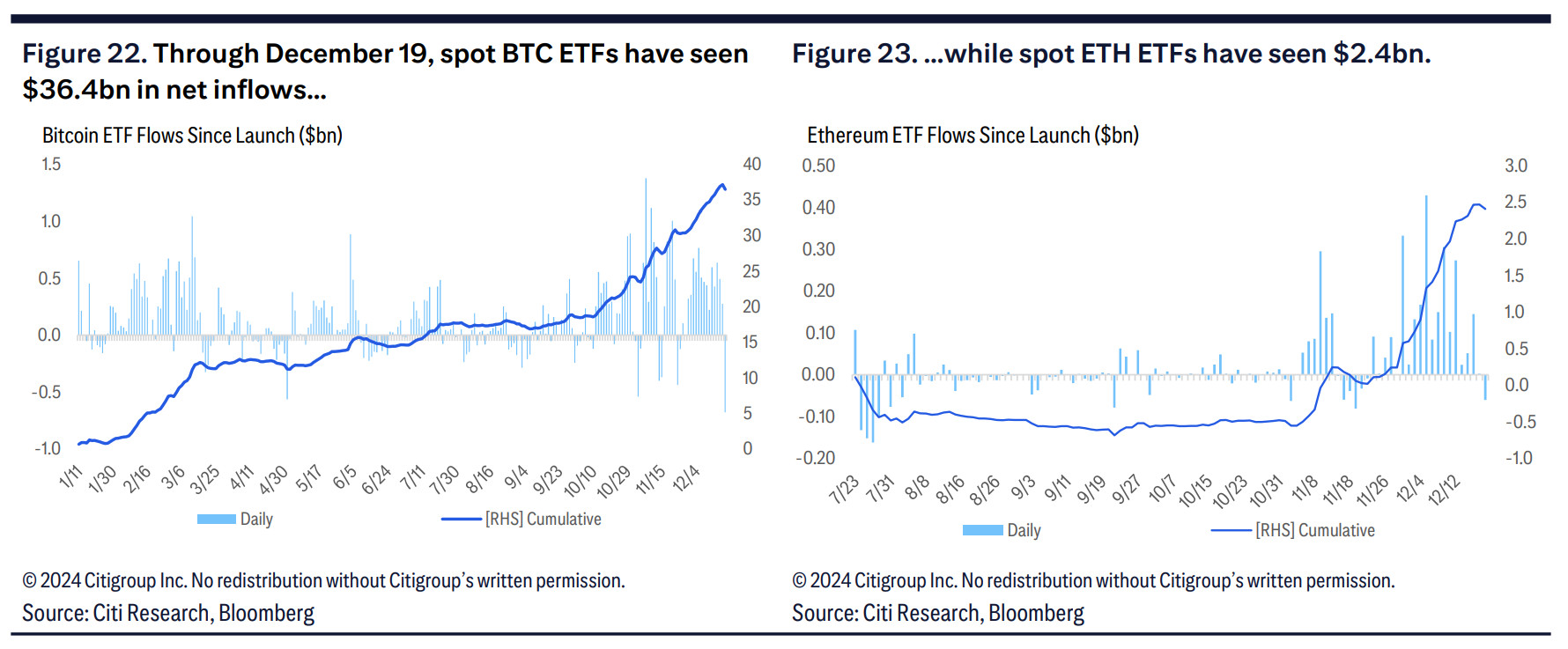

ETFs: A Gateway for Institutional Money

One of the biggest game-changers in the crypto space has been the steady inflow of institutional money through ETFs. Why do these matter so much? Simply put, ETFs provide mainstream investors with a convenient and regulated way to get crypto exposure without the complexity of managing private keys or digital wallets.

According to Citi’s report, ETF inflows are crucial because they represent new money entering the crypto market, rather than just existing traders moving funds around.

ETF Growth and Bitcoin’s Price Surge

Bitcoin (BTC) has been a major beneficiary of this trend, with ETF inflows accounting for 46% of BTC’s price movements in 2024. The correlation is clear: when Bitcoin ETFs attract more investment, BTC’s price goes up.

To put things in perspective, a $1 billion ETF inflow has historically translated to a 4.7% increase in Bitcoin’s price. Given that U.S. Bitcoin ETFs surpassed $100 billion in net assets for the first time in November, the market could be in for some serious upside in 2025.

Source: Citi

Source: Citi

If these trends continue, Bitcoin could experience “demand shocks”—an influx of institutional money that drives prices up faster than supply can keep up.

Stablecoins: The Lifeblood of the Crypto Economy

While Bitcoin and ETFs are making headlines, stablecoins are quietly laying the foundation for mass adoption. Their market caps surged by over $25 billion following the U.S. election in November, signaling increased demand for crypto transactions and decentralized finance (DeFi) applications.

Why Are Stablecoins So Important?

Stablecoins, such as Tether (USDT), USD Coin (USDC), and Dai (DAI), act as the on-ramp to DeFi. By providing a stable digital currency that’s not subject to wild volatility, they make it easier for users and institutions to participate in lending, borrowing, and trading across blockchain ecosystems.

Citi’s report also highlights that activity on Ethereum and its Layer-2 networks has skyrocketed by 210% compared to 2023. Combined with an increase in both large and small crypto wallets, this suggests a growing number of users engaging with blockchain-based financial systems.

The Takeaway: 2025 Could Be a Turning Point

With ETFs driving new money into the market and stablecoins fueling onchain activity, 2025 could be a defining year for cryptocurrency. Whether you’re an investor, trader, or just someone curious about where digital assets are headed, one thing is clear—crypto adoption is accelerating, and the financial landscape may never be the same again.

Will Bitcoin hit new highs? Will DeFi expand beyond expectations? Only time will tell, but one thing is for sure: the crypto revolution is just getting started. 🚀