The Rise of Bitcoin ETFs: A Game-Changer for Crypto Investment

A New Era for Bitcoin Investment

The approval of spot Bitcoin Exchange-Traded Funds (ETFs) in the U.S. was one of the most highly anticipated financial events in recent years. As 2024 came to a close, these ETFs held a staggering $129 billion in assets, setting the stage for an even bigger 2025.

ETFs, for those unfamiliar, are financial instruments that mirror the value of an asset they track. They provide a regulated, liquid, and easily accessible way to invest in Bitcoin without the complexities of direct ownership. Unlike futures-based ETFs, which saw moderate success, spot Bitcoin ETFs actually hold Bitcoin, making them more impactful on Bitcoin’s price and liquidity.

A Long-Awaited Victory for Spot BTC ETFs

For over a decade, firms like VanEck, WisdomTree, Bitwise, ARK Invest, and Grayscale battled to get a spot Bitcoin ETF approved. The U.S. Securities and Exchange Commission (SEC), however, repeatedly denied applications, citing concerns over price manipulation and market integrity.

In 2021, the SEC finally approved futures-based Bitcoin ETFs, with ProShares’ BITO making an impressive debut, hitting $1 billion in assets in just two days. But enthusiasm waned quickly. The complex structure of futures-based funds, coupled with a volatile crypto market, led to declining investor interest.

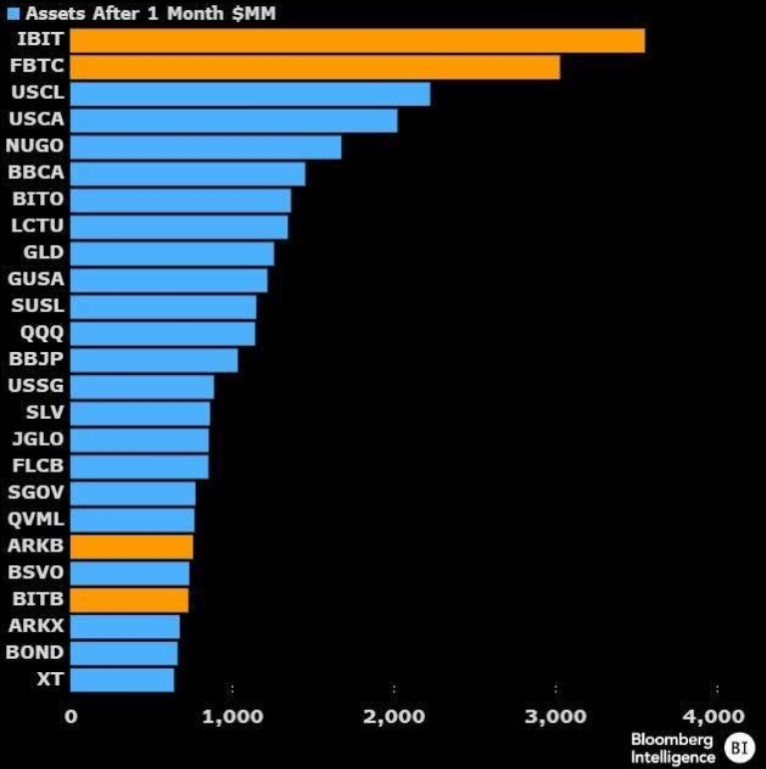

This all changed when spot Bitcoin ETFs launched. Within the first day, they racked up $2.2 billion in trading volume, with BlackRock’s iShares Bitcoin Trust (IBIT) alone crossing $1 billion. The Fidelity Wise Origin Bitcoin Fund (FBTC) also made waves, attracting over $3 billion in just a few weeks.

Bitcoin ETF Growth

Bitcoin ETF Growth

Spot Bitcoin ETF inflows after one month. Source: Bloomberg Intelligence

A large portion of this success came from investors migrating away from the Grayscale Bitcoin Trust (GBTC), which had long been the go-to Bitcoin investment vehicle but charged a hefty 1.5% fee. The new ETFs, with fees as low as 0.25%, quickly became the preferred choice.

Bitcoin ETFs Overtake Gold

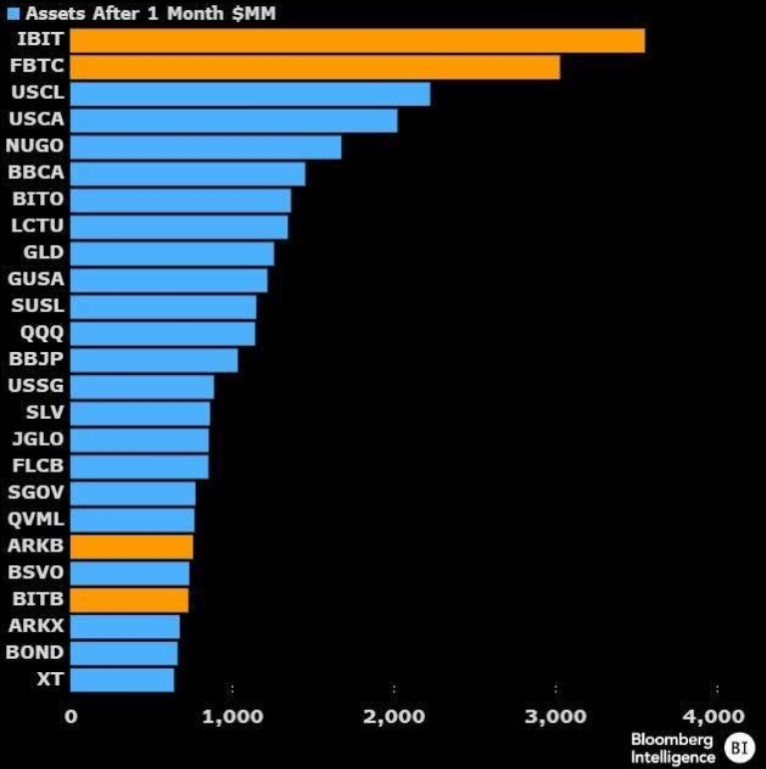

Bitcoin has often been compared to gold as a store of value, but in 2024, it officially outperformed it in ETF investments.

By November, BlackRock’s IBIT had amassed $33.2 billion in assets, surpassing the firm’s gold ETF, iShares Gold Trust (IAU). This shift wasn’t just limited to BlackRock—spot Bitcoin ETFs collectively held $120 billion by year-end, rivaling gold ETFs at $125 billion.

Bitcoin vs. Gold ETFs

Bitcoin vs. Gold ETFs

Net assets in US ETFs. Source: K33

This development marked a significant milestone: Bitcoin, a relatively new asset, was now competing with one of the most historically trusted stores of value.

Ethereum Joins the ETF Race

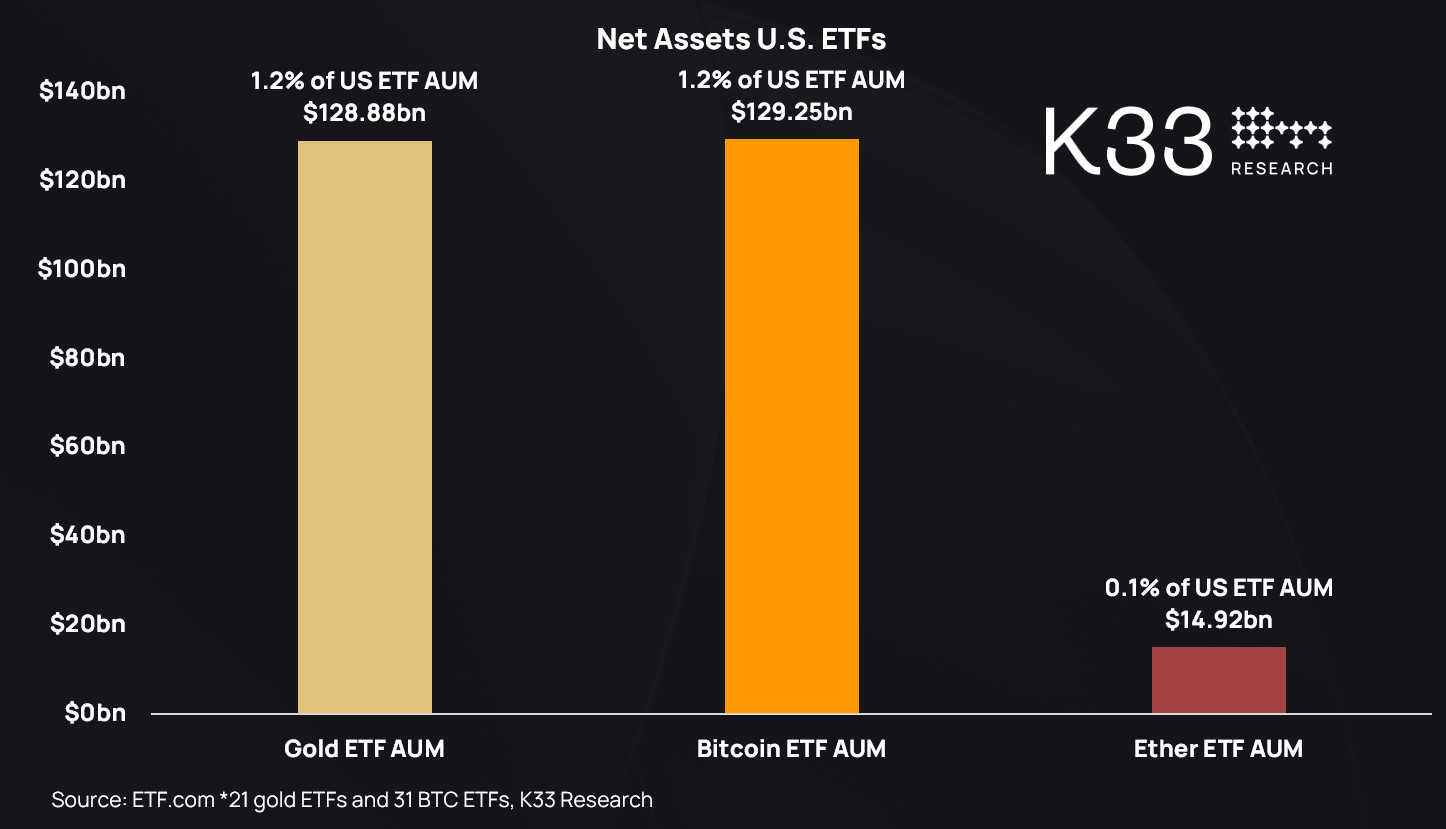

Not to be left behind, Ethereum entered the ETF market in July 2024. However, its launch was far more subdued compared to Bitcoin’s.

With an initial boost from the converted Grayscale Ethereum Trust (ETHE), Ethereum spot ETFs reached $11 billion in total assets by the end of the year. While impressive, this fell short of Bitcoin’s performance. Despite Ethereum’s potential, it seems investors still need more confidence in its long-term value proposition compared to Bitcoin.

Ethereum ETF Growth

Ethereum ETF Growth

Spot Ether ETF AUM. Source: The Block

What’s Next for Crypto ETFs in 2025?

Interest in crypto ETFs remains high moving into 2025. According to Farside, Bitcoin ETFs pulled in $1.1 billion in fresh investments in just the first month of the year.

As Bitcoin gains further institutional recognition, will we see other cryptocurrencies follow suit? Speculation is swirling around the possibility of a Solana (SOL) ETF, with market sentiment assigning a 74% probability of its approval in 2025. Similarly, the chances of an XRP ETF being greenlit hover around 70%. Firms such as VanEck and 21Shares have already filed applications.

Meanwhile, a major shakeup could come from an unexpected player: Vanguard. Historically resistant to crypto, Vanguard has remained on the sidelines. However, the recent leadership change—bringing in former BlackRock executive Salim Ramji as CEO—has sparked speculation that the $9 trillion asset management giant might finally embrace Bitcoin. If Vanguard joins the game, the potential impact could be massive.

Wrapping Up: A Defining Moment for Bitcoin and Crypto ETFs

The rapid success of spot Bitcoin ETFs in 2024 validated the demand for regulated crypto investment vehicles. They not only outperformed expectations but also overshadowed gold ETFs and opened the door for other digital assets to follow.

As 2025 unfolds, all eyes are on whether more cryptocurrency ETFs will emerge, making it easier than ever for investors to participate in this evolving space. Whether institutions like Vanguard will finally step in remains a big question, but one thing is certain: crypto ETFs are here to stay, and they’re changing the game.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Always do your own research before making financial decisions.