Solana Futures Now Trading on CME: What It Means for Crypto Investors

The financial world just got a little more exciting! Solana (SOL) futures have officially made their debut on the Chicago Mercantile Exchange (CME), marking a major step toward mainstream adoption for the cryptocurrency. But what does this mean for traders, investors, and the broader crypto market? Let’s break it down.

Solana Futures Hit the CME

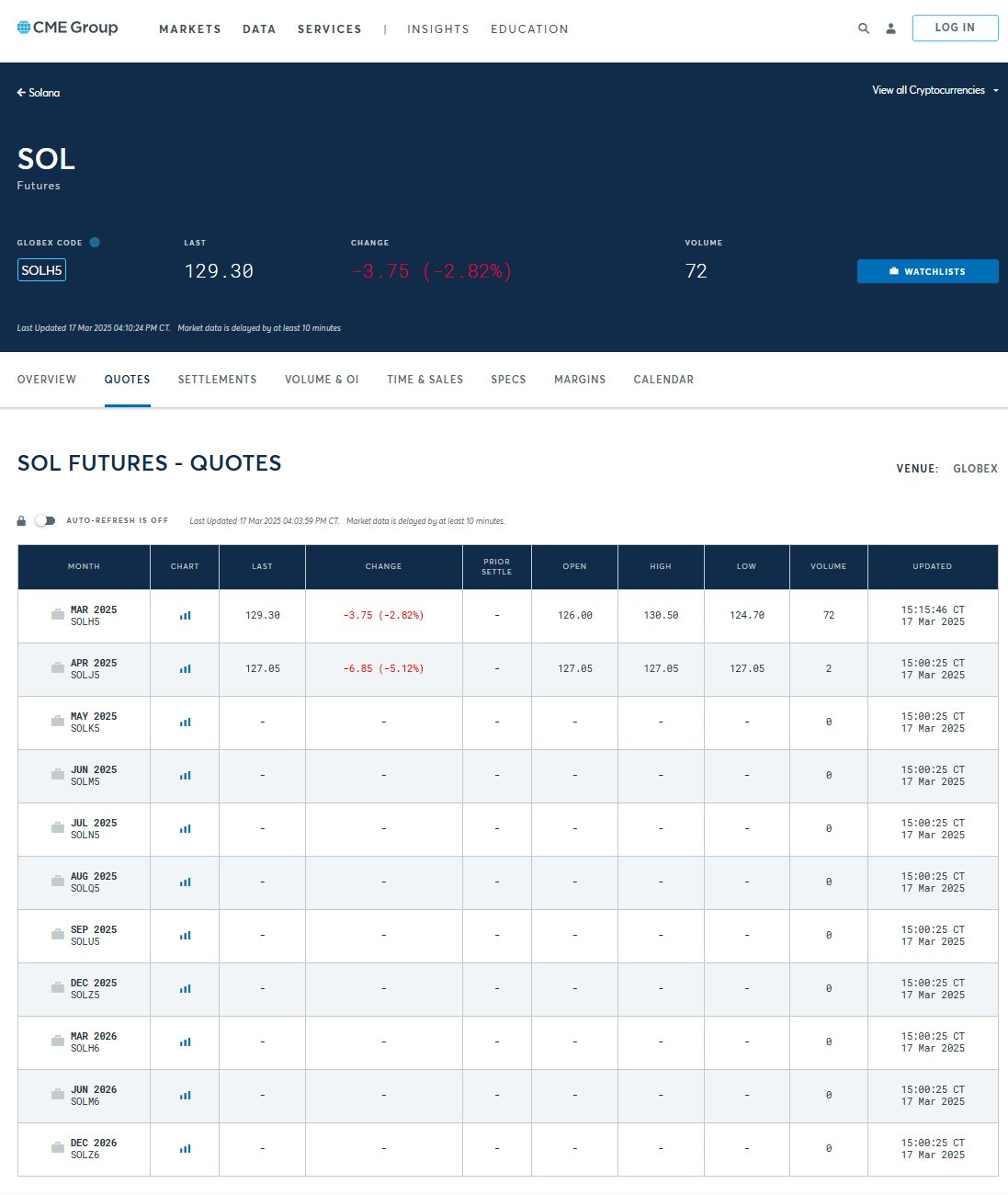

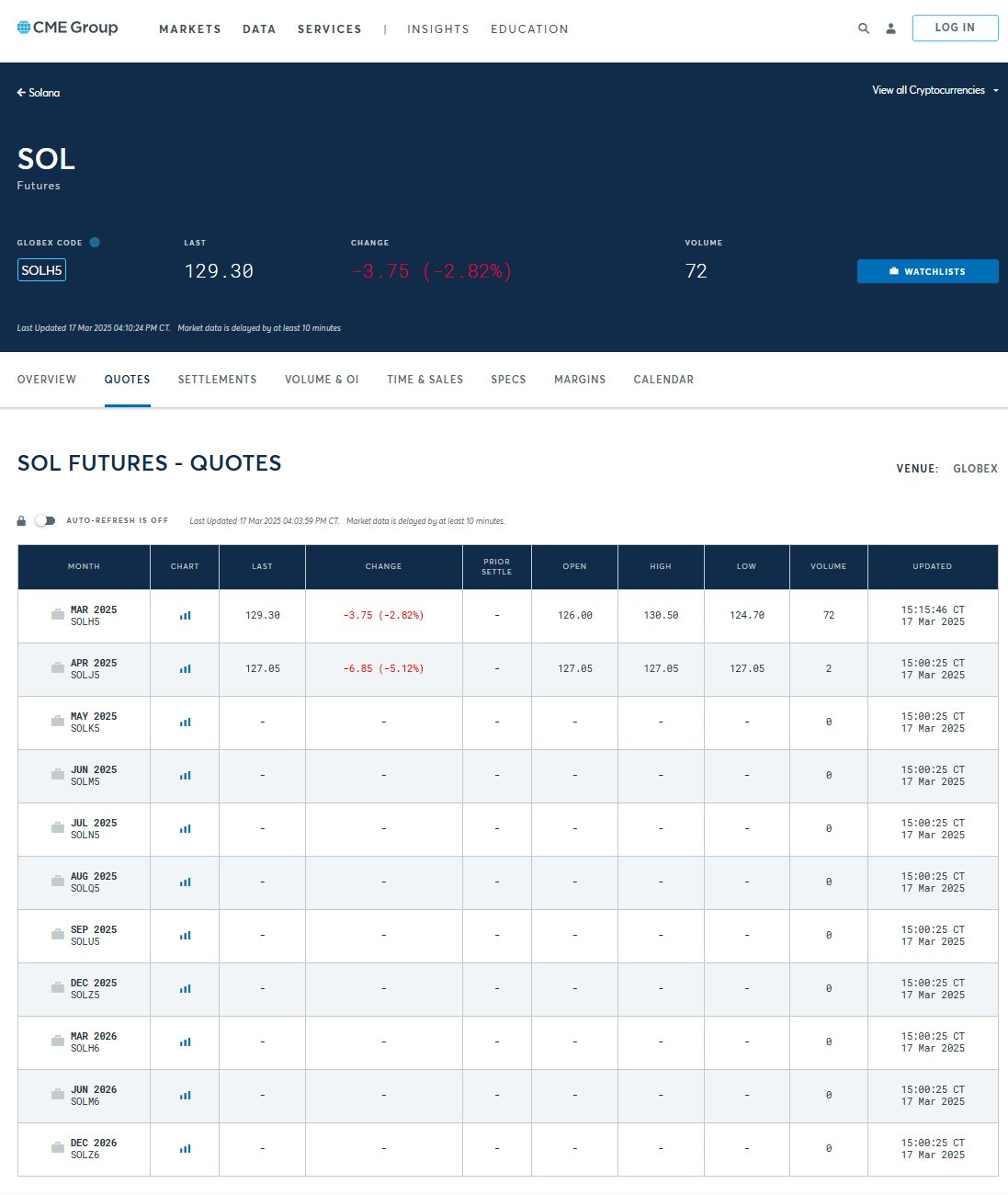

On March 17, the highly anticipated launch of Solana futures took place on CME’s US derivatives exchange. This move introduces two types of futures contracts:

- Standard SOL futures (representing 500 SOL per contract) for institutional traders.

- Micro SOL futures (representing 25 SOL per contract) for retail investors looking for more accessible entry points.

These contracts are cash-settled, meaning that no actual SOL changes hands—traders settle their positions in cash based on market prices. This marks the first-ever regulated SOL futures available in the United States, following a similar launch by Coinbase in February.

An Eventful First Trading Day

Solana’s CME futures saw impressive activity right out of the gate. On launch day, futures contracts tied to a total of 98,250 SOL—valued at approximately $12 million—were traded. This early volume underscores the growing interest in regulated crypto derivatives.

However, early pricing data suggests that traders may be slightly bearish on SOL. The April contracts traded at $127 per SOL, which was $2 lower than contracts expiring in March. While this discount isn’t dramatic, it reflects cautious sentiment among market participants.

Why This Matters

Futures contracts are a cornerstone of traditional finance, commonly used for both speculation and hedging against price swings. Their introduction to Solana isn’t just another trading instrument—it’s a sign that institutional confidence in SOL is rising.

Chris Chung, founder of Solana-based trading platform Titan, shared his excitement about the development:

“Solana has come a long way in the last five years. Solana futures are going live on the CME today, and SOL ETFs will surely follow shortly behind.”

The possibility of a Solana exchange-traded fund (ETF) is especially intriguing, as it would provide an even more accessible investment vehicle for traditional investors.

SOL futures on the CME

SOL futures on the CME

CME listed SOL futures on March 17. Source: CME

Are Solana ETFs Next?

The launch of Bitcoin (BTC) and Ethereum (ETH) futures on CME preceded the approval of spot ETFs for those assets. Could Solana follow the same path? Many analysts believe so.

Chris Chung predicted that the SEC could approve Solana ETFs as early as May, considering the growing demand. At present, at least five asset managers have filed for SOL-based ETFs, with the SEC required to make a final decision by October 2025.

Bloomberg Intelligence currently estimates the likelihood of Solana ETFs getting the green light at around 70%. That’s quite promising for investors hoping for broader institutional adoption.

Looking Ahead

The launch of Solana futures on CME is a huge milestone for the crypto industry. It signals increased regulatory recognition and opens the door for a potential Solana ETF approval in the near future. While the early bearish pricing is worth noting, the overall trajectory points to growing legitimacy and investor confidence.

For traders, whether retail or institutional, SOL futures provide a new way to navigate price movements, hedge positions, or speculate on the asset’s future.

So, is Solana the next Bitcoin or Ethereum in terms of institutional adoption? Only time will tell—but things are certainly moving in the right direction.

Related Reading

Solana CME Futures Could Pave the Way for US ETF Approvals

5 Real Use Cases for Useless Memecoins