Singapore Exchange (SGX) to Launch Bitcoin Perpetual Futures: A Game Changer?

The Dawn of a New Era for Bitcoin Futures in Singapore

Big news is brewing in Singapore’s financial scene! The Singapore Exchange (SGX), the country’s largest and most influential exchange group, is preparing to unveil Bitcoin perpetual futures. Slated for launch in the second half of 2025, this move has the potential to reshape the institutional crypto market in the region.

But what does this mean for investors, and why does it matter? Let’s break it down.

Opening Doors for Institutional Investors

According to Bloomberg, SGX is working on bringing Bitcoin (BTC) perpetual futures to institutional and professional investors. The goal? To expand institutional market access and offer a trusted trading avenue for cryptocurrency futures.

A spokesperson from SGX emphasized that with its Aa2 rating from Moody’s, the exchange seeks to provide a secure, regulated alternative for crypto derivatives trading. This could be a big step forward for institutions looking for credible exposure to Bitcoin—without actually holding the asset.

However, while institutional players might be celebrating, there’s a catch: Retail investors won’t have access to these products. The proposed Bitcoin futures are still awaiting approval from the Monetary Authority of Singapore (MAS) before they can officially launch.

What are Bitcoin Perpetual Futures?

Before diving deeper, let’s clarify what Bitcoin perpetual futures actually are.

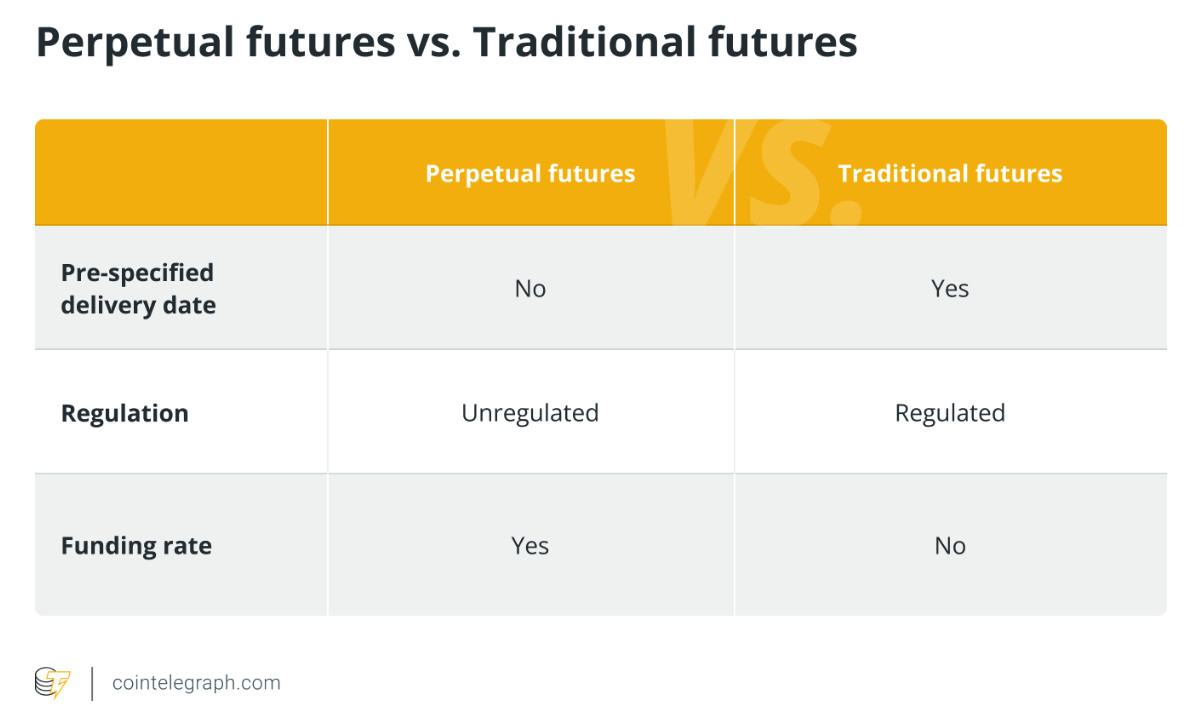

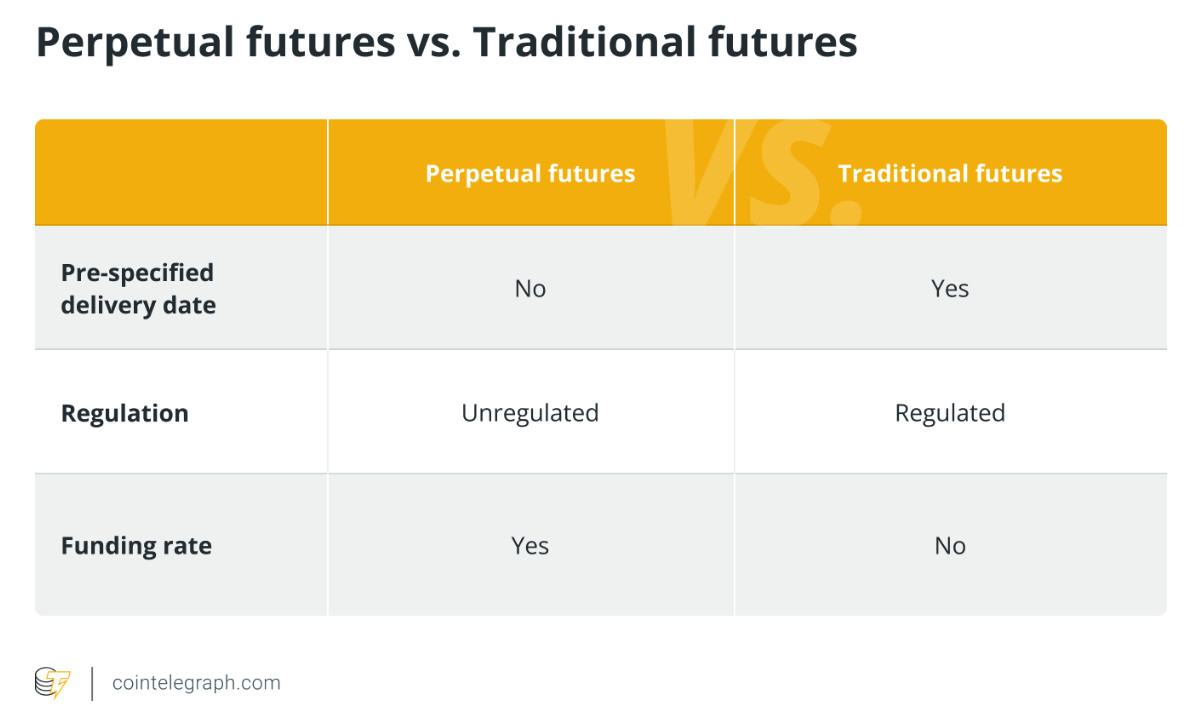

Bitcoin futures fall under the umbrella of cryptocurrency derivatives, allowing investors to bet on future price movements without actually owning BTC. Traditional futures contracts come with an expiration date, meaning you must settle the trade at a pre-determined time.

Here’s where perpetual futures stand out—they have no expiration date. Traders can hold their positions indefinitely, provided they meet margin requirements. This flexibility makes perpetual futures attractive to institutions looking for continuous market exposure.

This development aligns with Singapore’s broader strategy to position itself as a global hub for cryptocurrency and blockchain innovation. With the MAS supporting crypto-friendly regulations, Singapore has already doubled crypto-related licenses in 2024.

SGX’s move reinforces the nation’s pro-crypto stance, as a spokesperson stated:

“SGX Group is leading the way in the burgeoning international institutional crypto market with perpetual futures. While subject to due regulatory process, initial feedback on our product has been positive from both DeFi [decentralized finance] and TradFi [traditional finance] participants.”

A Growing Trend in Crypto Markets

SGX isn’t alone in its Bitcoin futures ambitions. Interest in regulated crypto derivatives is heating up across Asia.

Back in January 2025, EDX Markets, a Citadel Securities-backed crypto firm, revealed plans to offer crypto futures trading in Singapore. Simultaneously, traditional financial institutions in Japan are also taking steps in this direction.

On March 4, Bloomberg reported that the Osaka Dojima Exchange (ODE)—a major Japanese derivatives exchange—was seeking approval to list Bitcoin futures in Japan. If granted, Dojima would become one of the first traditional Asian exchanges to offer Bitcoin futures, a bold step for institutional adoption in the region.

What’s Next for Bitcoin Futures in Singapore?

With regulatory approval still pending, SGX’s Bitcoin perpetual futures aren’t a done deal just yet. However, the mere prospect of this offering signals a growing institutional appetite for cryptocurrency derivatives.

If all goes as planned, SGX’s move could pave the way for more regulated crypto investment opportunities in Singapore—potentially attracting more institutional capital into the digital assets space.

Final Thoughts

For crypto investors and enthusiasts, this is yet another sign that Bitcoin is no longer a fringe asset—it’s becoming a key financial instrument for institutions. While retail investors might not be able to jump in just yet, developments like this bring increased legitimacy, stability, and eventually—broader market participation.

One thing is clear: Singapore is doubling down on Bitcoin, and the world is watching.