The Rise of Real-World Asset Tokenization: A New Era for Investors

Introduction

With Bitcoin losing momentum and global financial uncertainties looming large, investors are on the lookout for stable, yield-generating alternatives. Enter real-world asset (RWA) tokenization—a transformative innovation revolutionizing traditional finance by bringing tangible assets like real estate and fine art onto the blockchain. But could RWAs soon outshine major cryptocurrencies in institutional adoption?

Let’s explore how this rapidly growing sector is poised to reshape global finance and why major institutions are taking notice.

The Shift Toward Tokenized Real-World Assets

RWA tokenization refers to the process of bringing real-world financial products onto blockchain networks to improve liquidity, accessibility, and transaction efficiency. Think of it as the bridge between conventional investing and decentralized finance (DeFi).

Recent global financial turbulence—exemplified by Bitcoin (BTC)’s decline below the $100,000 psychological mark—has compounded investor concerns. The decline followed market jitters over a new wave of import tariffs announced by the U.S. and China, leading some to reconsider their crypto allocations.

According to Alexander Loktev, Chief Revenue Officer at P2P.org, Bitcoin’s sluggish price movement may catalyze a surge in RWA investments. He told Cointelegraph:

“Given the recent moves we’ve seen from major financial institutions, particularly BlackRock and JPMorgan’s growing involvement in tokenization, I believe we could hit $50 billion in TVL.”

The growing interest from traditional finance (TradFi) institutions in RWAs suggests that tokenized assets are being recognized as credible investment vehicles, offering predictable yields and stability.

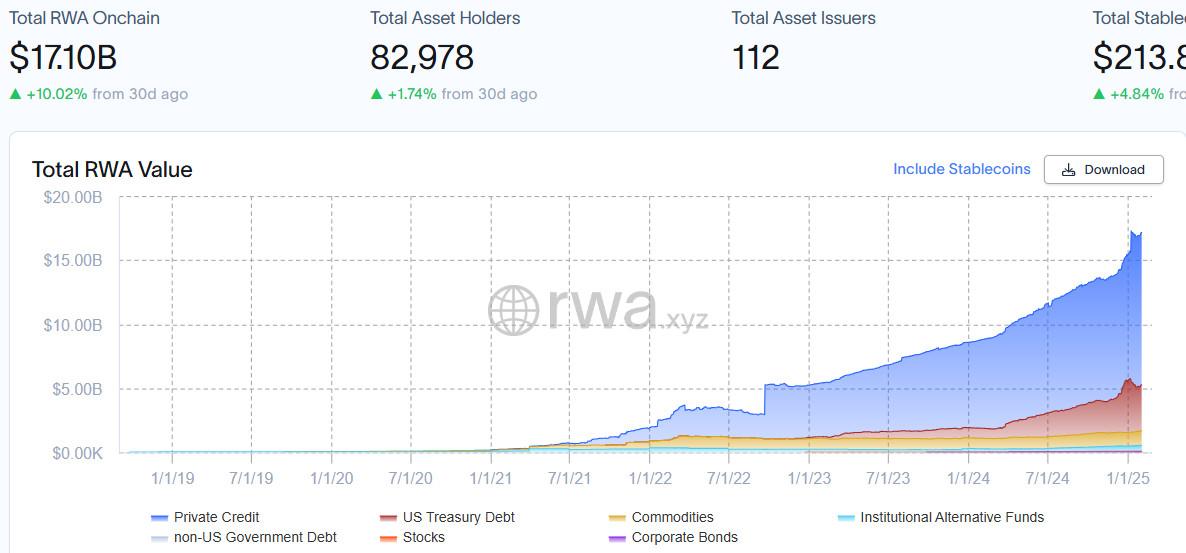

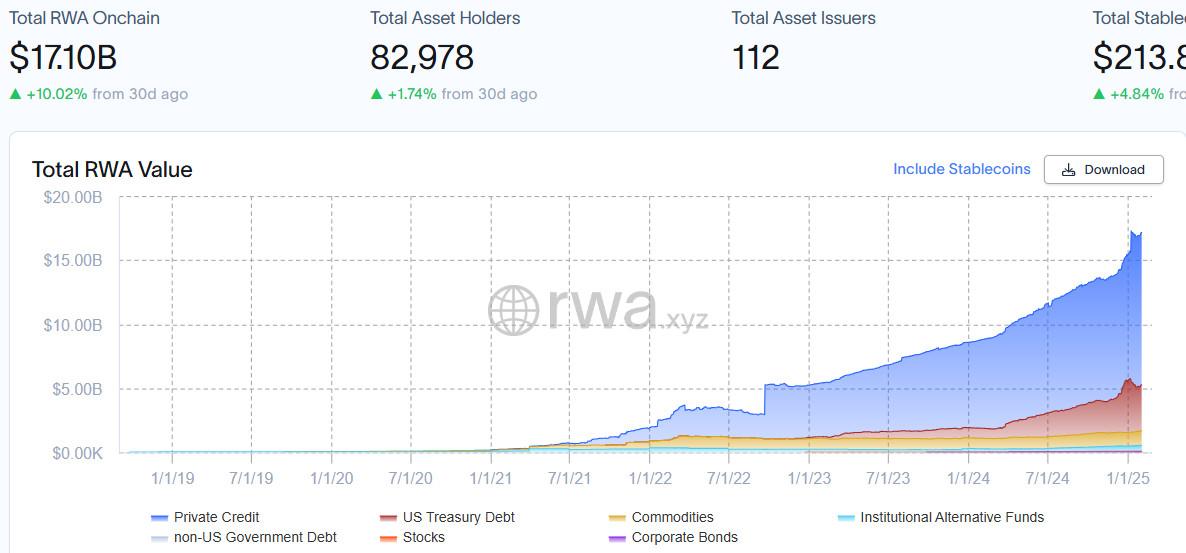

RWA global dashboard

RWA global dashboard

Can Tokenized RWAs Capture a Slice of the $450 Trillion Asset Market?

The appetite for RWAs isn’t just about crypto market downturns—it’s about the broader shift toward democratized investing and improved liquidity. In fact, RWAs could claim a small yet impactful share of the $450 trillion global asset market, says Marcin Kazmierczak, co-founder and COO at blockchain oracle solution RedStone.

He explains:

“Traditional financial markets handle over $450 trillion in total assets, with institutional investors managing roughly $100 trillion. Even a modest 1–2% shift of these assets to blockchain-based RWAs could drive significant growth in 2025.”

As blockchain technology increasingly offers more efficient, borderless, and composable financial infrastructure, it’s only a matter of time before more capital moves towards tokenized markets.

Crypto Volatility: A Catalyst for Institutional RWA Adoption

Market turbulence has always played a crucial role in reshaping investment strategies. As we’ve seen with Bitcoin price fluctuations and this week’s $10 billion liquidation event, institutional investors are searching for assets that provide a hedge against volatility.

Bhaji Illuminati, CMO at Centrifuge, an RWA-based DeFi lending protocol, believes more investors will pivot towards RWAs as a stable alternative:

“Huge swings in crypto prices always serve as a reminder of the importance of stable, yield-bearing assets. RWAs, especially fixed income, provide exactly that: a portfolio hedge against crypto volatility.”

Unlike speculative crypto investments, RWAs align more closely with fundamental economic value, and this shift is expected to endure. Some analysts predict that the RWA market could grow up to 50-fold by 2030—reaching as much as $30 trillion—as TradFi firms move deeper into blockchain-powered financial infrastructure.

The Future of RWAs: What Lies Ahead?

With growing institutional adoption, regulatory developments, and increasing market liquidity, RWAs are quickly becoming one of the hottest investment narratives for 2025.

As financial giants like BlackRock and JPMorgan continue leading the push toward asset tokenization, we are witnessing the early stages of a fundamental transformation in how global finance operates. The question is no longer if RWAs will become mainstream, but when.

Will RWAs redefine the investment landscape and outperform traditional financial assets? Only time will tell—but all signs point to a paradigm shift unfolding before our eyes.

Related: How Crypto Laws Are Changing Across the World in 2025