Bitcoin Crosses $100,000 – A Historic Milestone for Crypto

The crypto world has just witnessed another groundbreaking moment—Bitcoin has surged past the $100,000 mark for the first time in history! This milestone has sent waves of excitement across the market, fueling speculation about what’s next for Bitcoin and the broader crypto space. Let’s dive into what’s driving this surge and what it could mean for investors.

The Fuel Behind Bitcoin’s Ascent

Bitcoin’s latest rally isn’t just a fluke—it’s backed by strong institutional interest and massive capital inflows. One of the key players in this surge is MicroStrategy, a company that has been at the forefront of corporate Bitcoin adoption. On January 6, it revealed a fresh Bitcoin purchase of 1,070 BTC for a whopping $101 million, bringing its total holdings to an astonishing 447,470 BTC.

Adding to the frenzy, fintech firm Metalplanet’s CEO Simon Gerovich announced plans to boost its Bitcoin holdings from 1,762 BTC to 10,000 BTC in 2025, reinforcing the growing institutional faith in Bitcoin.

Moreover, cryptocurrency investment products have seen impressive inflows, with $585 million pouring in within the first three days of the year. This follows a record-breaking $44 billion in crypto inflows in 2024, as per CoinShares. Clearly, investors—both retail and institutional—are placing major bets on Bitcoin’s upward trajectory.

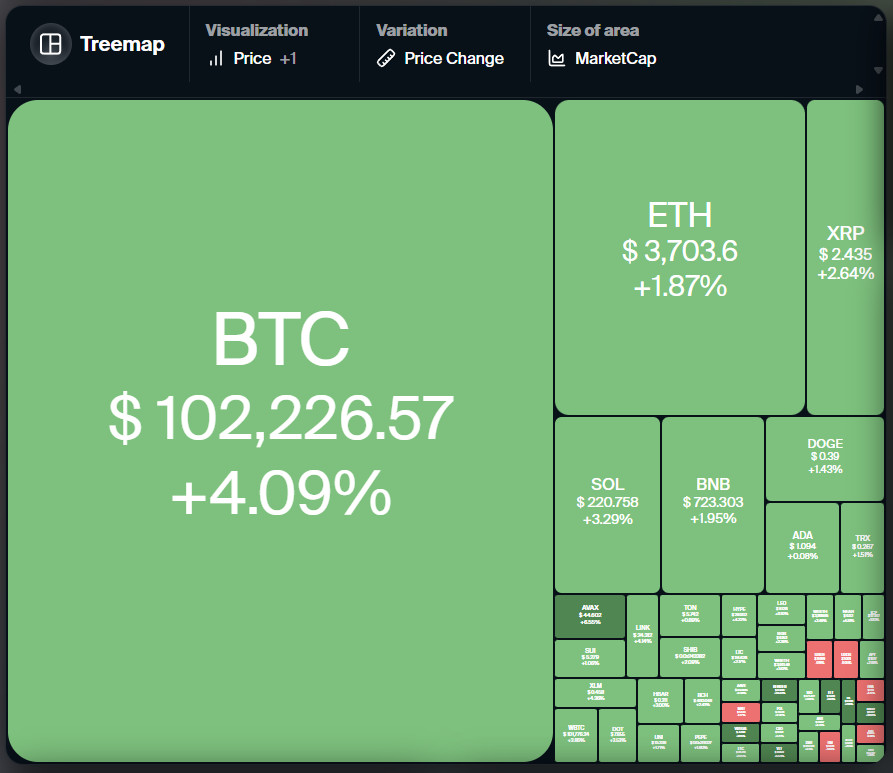

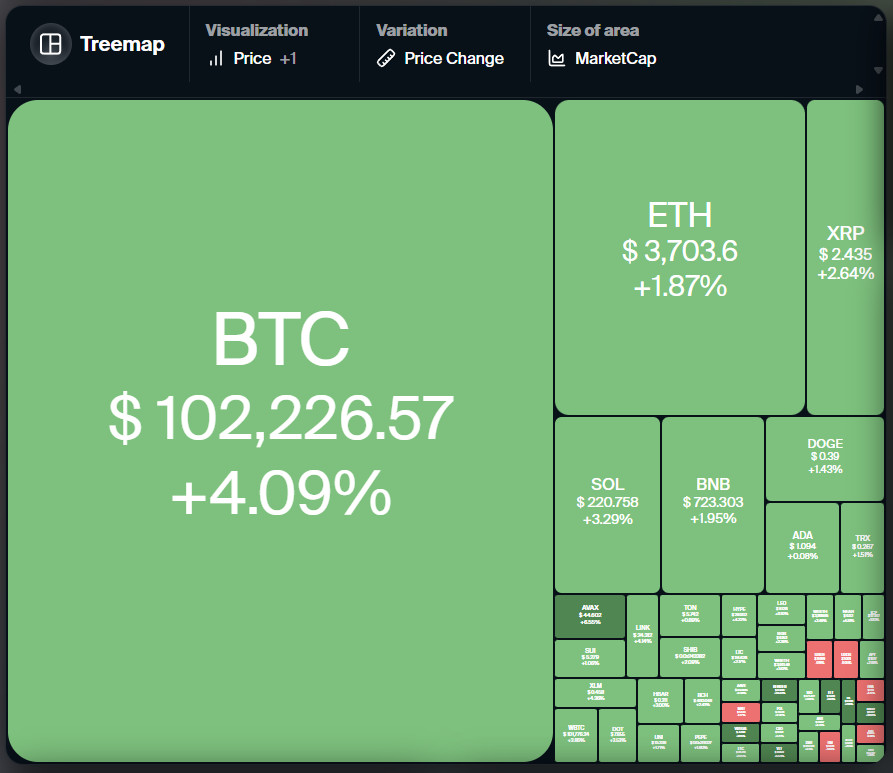

Market Snapshot

Market Snapshot

Daily Crypto Market Performance. Source: Coin360

What’s Next for Bitcoin?

Despite all the bullish momentum, some experts are exercising caution in the short term. According to 10x Research’s Markus Thielen, Bitcoin may consolidate within the $97,000 – $98,000 range for the remainder of January. However, if sustained buying pressure continues, we might see a push toward new all-time highs.

Will Bitcoin’s impressive rally spill over into the altcoins? Let’s take a closer look at the charts and key technical indicators.

Market Analysis

Bitcoin ($BTC) – Bulls in Control

Bitcoin’s leap above $100,000 is a significant psychological and technical milestone. If the price remains steady above this level, we could see a quick run toward the previous all-time high of $108,353, with further potential to hit the $126,706 zone.

However, if Bitcoin struggles to maintain this level, there’s a chance we might see a dip back toward $90,000, which would test investors’ confidence.

BTC Chart

BTC Chart

BTC/USDT Daily Chart. Source: Cointelegraph/TradingView

Ethereum ($ETH) – Ready for Takeoff?

Ethereum has decisively broken above $3,555, confirming a bullish ascending triangle breakout. This puts $3,894 as the next major target, with strong bullish sentiment taking hold.

However, if bears manage to drag ETH below $3,555, we might see a pullback—potentially testing support near the uptrend line.

ETH Chart

ETH Chart

ETH/USDT Daily Chart. Source: Cointelegraph/TradingView

XRP, BNB, and Other Altcoins – Who’s Leading the Pack?

XRP ($XRP)

- Currently facing resistance but maintaining support above the 20-day EMA ($2.29).

- A breakout above $2.91 could fuel a rally toward $3.50+.

Binance Coin ($BNB)

- Stuck in a tight consolidation between $703 and $722.

- A breakout above $722 could send BNB toward $794.

Solana ($SOL)

- Successfully climbed past the 50-day SMA ($219), indicating renewed bullish momentum.

- Potential targets? $235, then $247.

Dogecoin ($DOGE)

- Closed above the 50-day SMA ($0.38) with bullish momentum picking up.

- A push beyond $0.40 might trigger a swift move toward $0.48.

Cardano ($ADA)

- Resistance seen around $1.12, but bulls refuse to back down.

- A move past $1.20 could see ADA rally toward $1.32.

Avalanche ($AVAX)

- Broke past the 50-day SMA ($43.23), showing strength.

- Resistance lies between $44.70 – $47.31, which must be cleared for the next leg up.

Market Snapshot

If these key altcoins break past their respective resistance levels, we could see a broader altcoin rally fueled by Bitcoin’s momentum. However, keep an eye on macroeconomic factors and market sentiment, as these could shift trends quickly.

Final Thoughts

Bitcoin reaching $100,000 is a landmark event, but the real question remains—where does it go from here? While short-term pullbacks are possible, institutional interest and increasing adoption suggest Bitcoin’s long-term trajectory remains bullish.

For investors, the lesson here is patience. Expect volatility, but keep an eye on the macro trends driving crypto’s growth. With regulatory clarity improving and corporate entities doubling down on BTC, the future looks promising.

💡 What’s your take—will Bitcoin maintain this bullish momentum, or is a correction overdue? Let us know in the comments!

📌 Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research before making investment decisions.