Bitcoin’s Next Big Rally: How Nvidia’s Plunge and Crypto IPOs Could Fuel a Breakout

A Market Shake-Up with Unexpected Perks

The crypto world thrives on surprises, and recent market shifts suggest that Bitcoin could be in for a major upswing. Analysts are pointing to two key factors that may set the stage for a Bitcoin rally: the massive drop in Nvidia’s market valuation and an upcoming wave of highly anticipated cryptocurrency IPOs. If you’re wondering what GPUs and Bitcoin have in common, let’s dive into why this unusual combination could work in favor of Bitcoin’s price.

Nvidia’s $600 Billion Wipeout – A Boon for Bitcoin?

Tech giant Nvidia saw an eye-watering 17% drop in its stock price on January 27, shedding nearly $600 billion in market value – the largest single-day loss in U.S. stock history. The sudden decline was triggered by investor panic over the latest AI model from Chinese firm DeepSeek, which is now seen as a serious competitor to OpenAI’s ChatGPT.

But here’s the twist – this setback for Nvidia might actually be a bullish sign for Bitcoin. According to a report by 10x Research, the drop in Nvidia’s value could result in reduced spending on AI, alleviating inflationary pressures. As inflation cools down, the U.S. Federal Reserve may ease its monetary policy, creating an environment where Bitcoin could flourish.

“Reducing AI spending keeps share buybacks as a key driver of U.S. equity returns and eases inflationary pressures, addressing the Fed’s concerns and making them marginally less hawkish.”

In simpler terms, less money chasing AI dominance could mean more room for Bitcoin to grow.

Major Crypto IPOs Set to Fuel Bitcoin Prices

On top of Nvidia’s shakeup, a wave of crypto IPOs set to hit the market in 2025 could drive Bitcoin even higher. As crypto companies prepare to go public, there is a clear incentive to keep Bitcoin’s price strong—because let’s face it, a thriving Bitcoin market makes these IPOs much more attractive to investors.

The Big Players Entering the Market

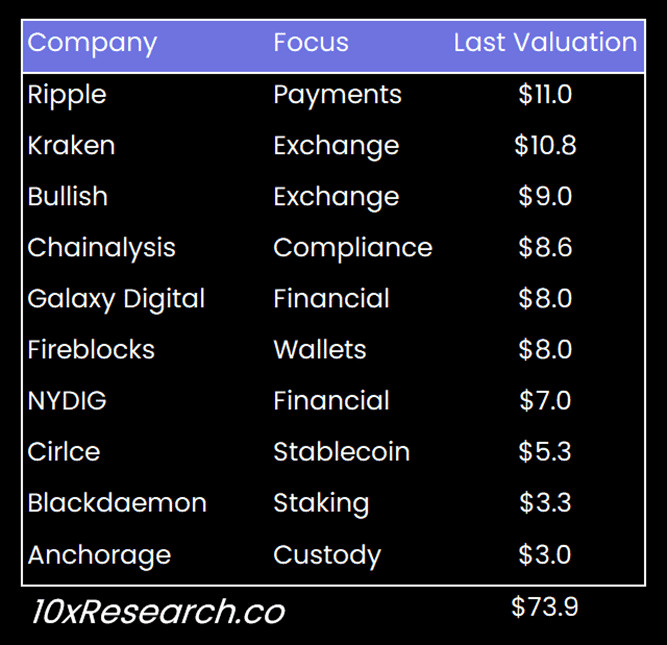

At least 10 major crypto firms are gearing up for IPOs in 2025, with a combined valuation exceeding $73.9 billion. This is significant, as Bitcoin’s price trajectory historically aligns with major crypto-related IPOs. Case in point? Just look at how Bitcoin’s price skyrocketed leading up to Coinbase’s IPO in 2021.

Top crypto companies preparing for a potential IPO. Source: 10x Research

“With a pipeline of high-profile crypto ‘financial’ companies aiming to go public this year, inflated valuations will likely depend on maintaining a sky-high Bitcoin price—a trend worth watching closely.”

This “financial gamesmanship,” as analysts call it, suggests that crypto firms will have a vested interest in keeping Bitcoin prices strong well into 2025.

Could Bitcoin Touch $110,000 Before a Short-Term Dip?

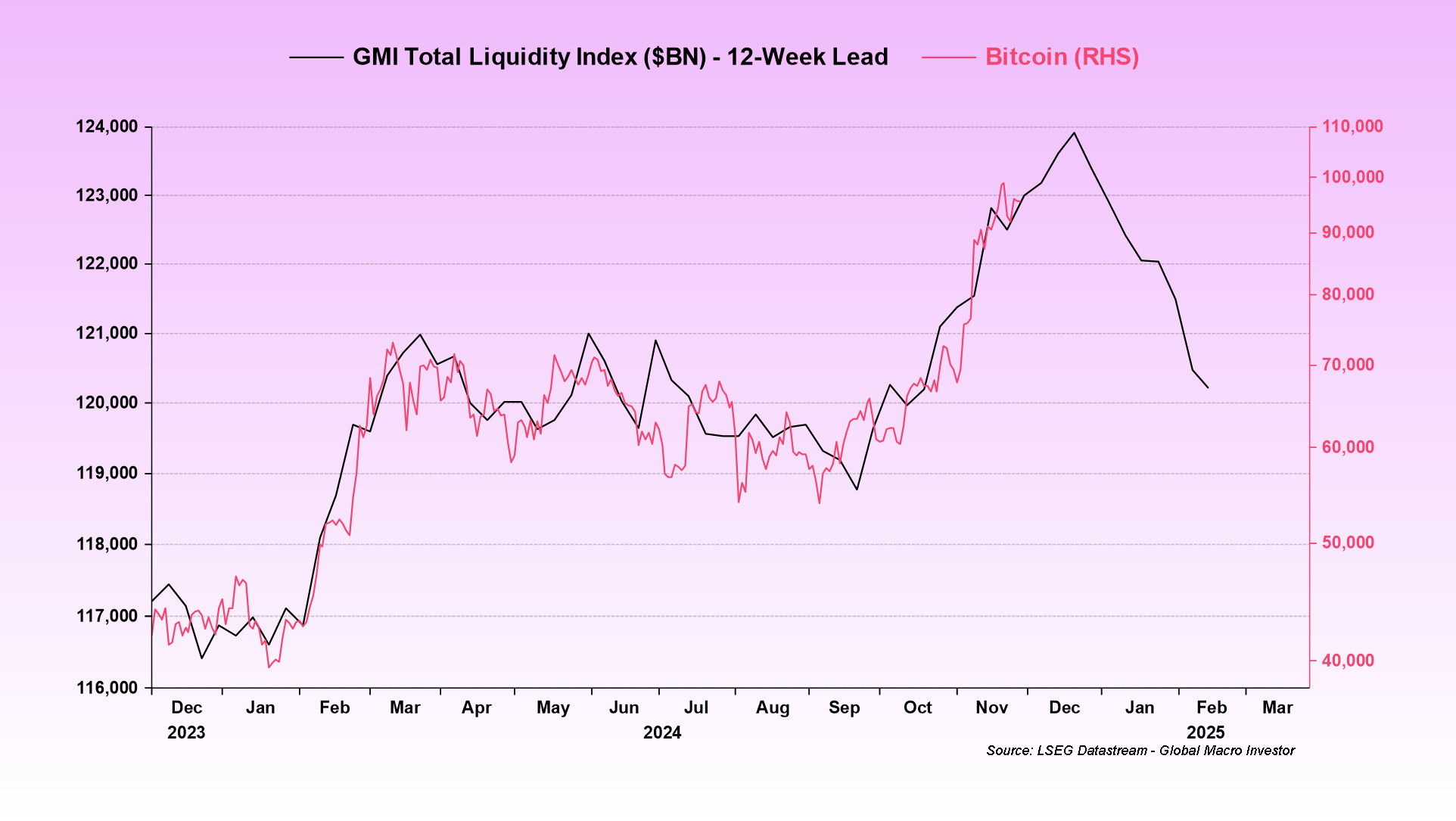

Bitcoin analysts are keeping a close eye on another key indicator: global liquidity trends. Raoul Pal, founder and CEO of Global Macro Investor, predicts that Bitcoin will hit a local top around $110,000 before potentially dipping below $70,000 as liquidity tightens.

GMI Total Liquidity Index, Bitcoin (RHS). Source: Raoul Pal

So, while Bitcoin could go on a massive rally in early 2025, investors should remain aware of potential corrections.

Final Thoughts: Is a Bitcoin Boom on the Horizon?

With Nvidia’s valuation drop reshaping tech investments and a string of crypto IPOs creating momentum, everything seems to be aligning for a Bitcoin price breakout in 2025. While short-term price dips might occur, analysts suggest that the long-term outlook remains overwhelmingly bullish.

For investors and Bitcoin enthusiasts alike, the coming months could be an exciting ride. Whether you’re holding, trading, or just watching from the sidelines, keep an eye on these trends—they might just shape Bitcoin’s next big move.

Related: Arizona Senate moves forward with Bitcoin reserve legislation