The Rise of AI-Powered Crypto Scams: A Looming Threat for 2025

Introduction

Imagine this: You’re scrolling online, looking for new investment opportunities, when you come across a seemingly legitimate trading site backed by stellar reviews and professional-looking endorsements. You decide to invest, only to realize later that it was an AI-generated scam. Sounds terrifying, right?

According to blockchain analytics firm Chainalysis, the world of cryptocurrency scams is evolving at an alarming pace, and 2025 could see the worst year yet. With artificial intelligence (AI) and professional scamming networks providing scammers with cutting-edge tools, fraudulent activities are becoming more sophisticated, scalable, and harder to detect.

AI: The New Engine Behind Crypto Scams

Chainalysis, in its 2024 Crypto Scam Revenue report, highlights how generative AI (GenAI) is revolutionizing scams by making them cheaper, more scalable, and far more convincing.

“Elad Fouks, Chainalysis’ head of fraud products, puts it bluntly: GenAI is amplifying scams—the leading threat to financial institutions—by enabling high-fidelity, low-cost, and highly scalable fraud that exploits human vulnerabilities.”

In simpler terms, AI is making scams look more real than ever before. Fraudsters can now create sophisticated fake identities, forge documentation with precision, and bypass traditional identity verification barriers effortlessly.

The Billion-Dollar Fraud Industry

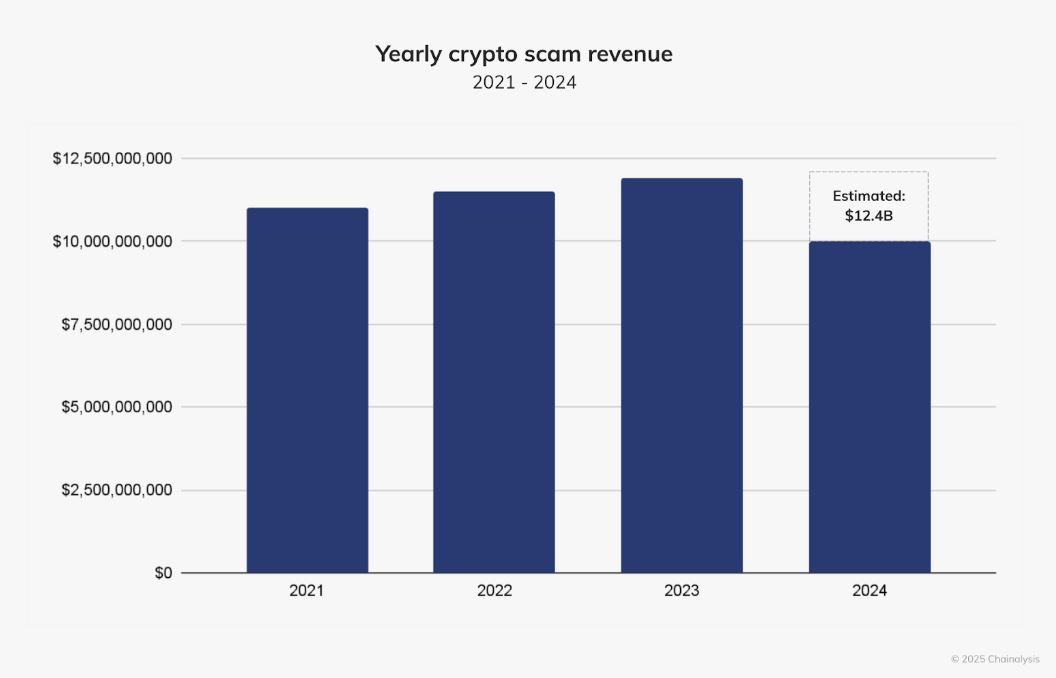

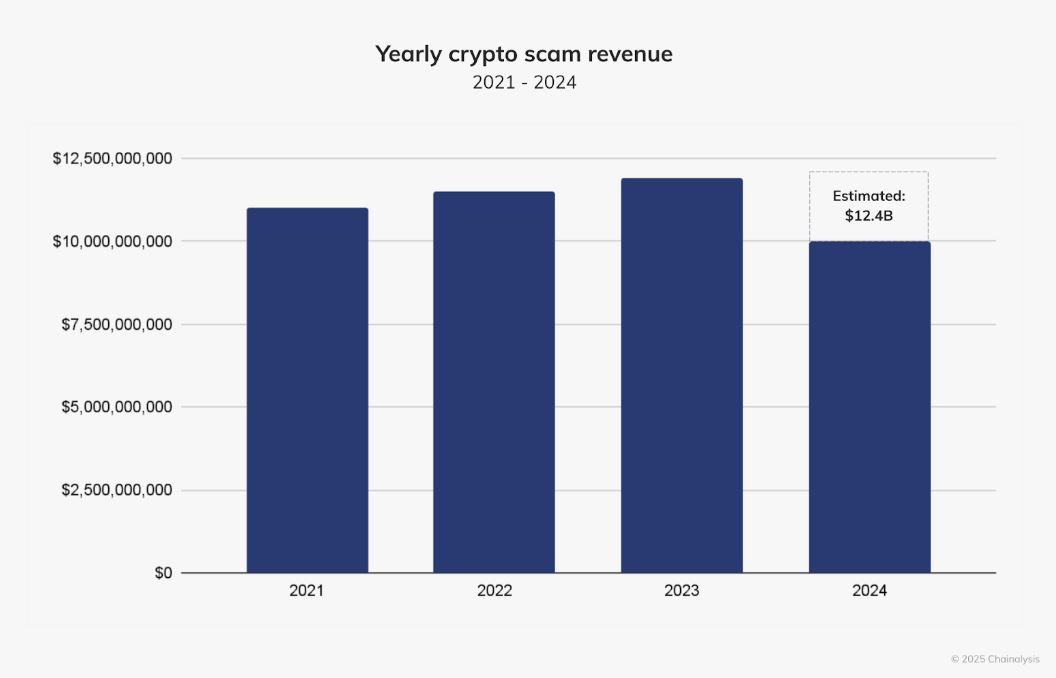

Crypto fraud is a massive industry, and it’s only getting bigger. In 2024 alone, scam revenue reached a staggering $9.9 billion, with Chainalysis expecting this figure to surpass $12 billion as more fraudulent addresses come to light.

The scamming industry is booming due to:

- Pig Butchering Scams – Long-term psychological manipulation to siphon off victims’ funds.

- Investment and Purchase Scams – Fake platforms impersonating legitimate exchanges and marketplaces.

- AI-Powered Deception – The ability to create near-perfect fake content, from websites to social media endorsements.

Scam revenue trends

Scam revenue trends

Scam revenue was lower in 2024, but Chainalysis expects numbers to rise as fraudulent activities get detected. Source: Chainalysis

AI is Helping Scammers Bypass Security

One of the most alarming findings in the Chainalysis report is that 85% of scams involve fully verified accounts that bypass traditional identity-based security measures.

This means that KYC (Know Your Customer) and AML (Anti-Money Laundering) protections, which are supposed to prevent fraud, are no longer foolproof. With AI, scammers can craft highly convincing fake identities, allowing them to slip past verification checks undetected.

Elad Fouks explains: “GenAI enables the generation of realistic fake content, including websites and listings, to power investment scams, purchase scams, and more.”

A $40 Billion Problem by 2027

The impact of AI-driven fraud extends far beyond just crypto. According to Deloitte’s Center for Financial Services, deepfake and AI-powered scams could cost the U.S. economy $40 billion by 2027. This signals a growing crisis not just for retail investors, but for financial institutions and regulatory bodies worldwide.

Huione and the Dark Economy of Scamming

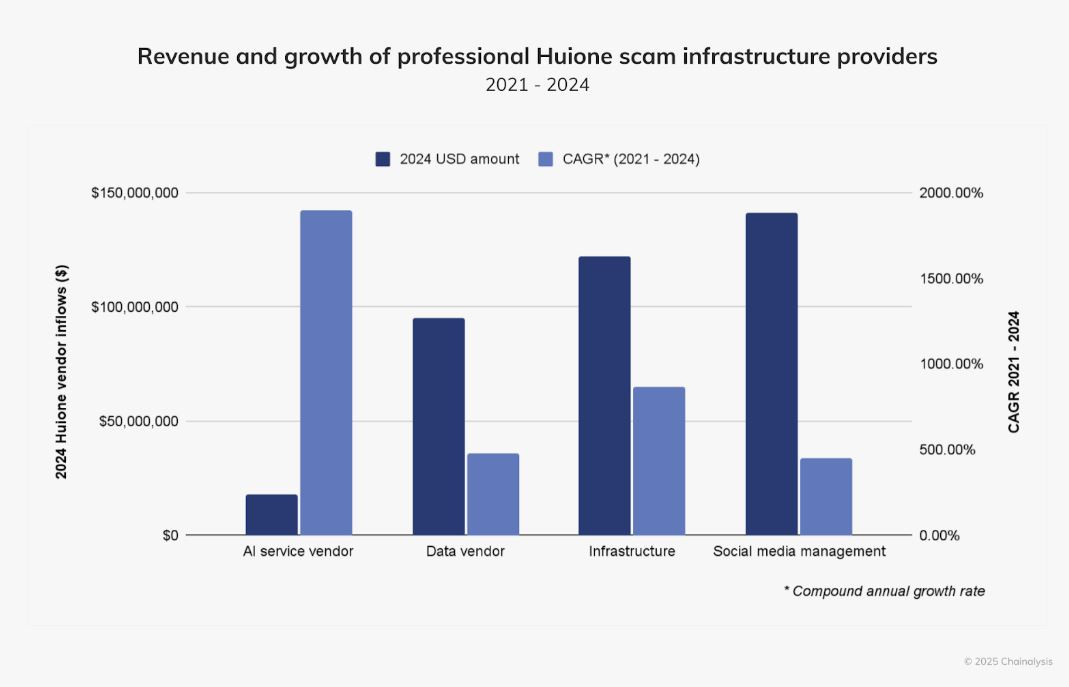

It’s not just individual scammers that are leveraging AI—there’s an entire underground economy supporting fraudulent activities.

Take Huione Guarantee, a peer-to-peer (P2P) marketplace notorious for facilitating scams while simultaneously offering legitimate services. Chainalysis’ research shows that between 2021 and 2024, businesses supporting scam infrastructure—like AI service providers—saw a revenue increase of 1,900%.

Huione scam economy

Huione scam economy

Huione scam technology vendors collectively received at least $375.9 million in crypto in 2024. Source: Chainalysis

The explosive growth of AI-driven scam infrastructure proves that fraud has become highly organized, with professional scammer networks operating almost like legitimate businesses.

Authorities Are Sounding the Alarm

Even the U.S. Federal Bureau of Investigation (FBI) has started warning the public about the role of GenAI in crypto scams. In a notice issued last December, they highlighted how criminals are leveraging AI-generated content to trick investors into making fraudulent crypto transactions.

Adding to the concern, Chainalysis estimates that crypto scam activity grows by an average of 24% per year. If this trend continues, AI-powered scams could soon overshadow all other forms of fraudulent cyber activity.

What Can We Do?

With AI making scams more advanced and harder to detect, staying informed is the best line of defense. Here’s how you can protect yourself:

- Verify Before You Invest – Always cross-check websites, businesses, and investment opportunities before committing money.

- Look for Red Flags – Too-good-to-be-true returns, unsolicited investment offers, and poor grammar or inconsistent information are all common scam indicators.

- Use Secure Platforms – Stick to reputable, well-regulated exchanges that have strong security measures in place.

- Enable Multi-Factor Authentication – Adding an extra layer of security makes it harder for scammers to gain access to your accounts.

- Stay Updated on Scam Trends – Knowledge is power. Follow trusted sources like Chainalysis and cybersecurity blogs to keep up with new fraud tactics.

Final Thoughts

AI is revolutionizing the way scams operate, making them harder to spot and easier to execute at scale. As we move into 2025, crypto investors and financial institutions must stay vigilant—because if the data is any indication, we are on the brink of the biggest year for crypto fraud in history.

By staying informed and cautious, you can avoid falling victim to these evolving threats. The best defense? Knowledge, awareness, and careful financial decision-making.

Related: Ransomware Losses Down 35% Year-over-Year: Chainalysis