Global Trade Tensions and Interest Rates: What’s Next for Crypto and Traditional Markets?

As markets continue reacting to economic shifts, two major factors are shaping the financial landscape: global trade policies and Federal Reserve interest rate decisions. For both cryptocurrency and traditional market investors, understanding these developments is crucial for navigating the coming months.

Trade Tariffs: A Looming Pressure on Markets

Bitcoin (BTC) has seen a significant decline of over 17% since January 20, when U.S. President Donald Trump announced import tariffs on Chinese goods. This move has amplified uncertainty across markets, affecting risk assets globally.

Despite numerous promising developments within the crypto sector, fears surrounding trade tariffs are expected to pressure prices until at least April 2. According to Nicolai Sondergaard, a research analyst at Nansen, the outcome of these international negotiations will be a key market driver:

“I’m looking forward to seeing what happens with the tariffs from April 2nd onwards. Maybe we’ll see some of them dropped, but it depends on whether all countries can agree. That’s the biggest driver at this moment.”

The uncertainty surrounding these tariffs has left risk assets in a state of limbo. However, should a resolution emerge between April and July, it could act as a major catalyst for the markets, potentially driving Bitcoin and other digital assets upward.

BTC/USD, 1-day chart. Source: Cointelegraph / TradingView

Adding to the complexity, President Trump’s reciprocal tariff rates are set to take effect on April 2, despite earlier indications from Treasury Secretary Scott Bessent suggesting a possible delay. The market remains on edge, waiting for a clearer picture.

Related: Ethereum Risks Correction to $1.8K Amid ETF and Tariff Concerns

Interest Rates and Investor Sentiment

While trade tensions dominate headlines, another key player influencing the markets is the Federal Reserve. High interest rates are making investors wary, and until the Fed pivots towards easing, the appetite for riskier assets may remain subdued.

Sondergaard weighed in on this dynamic, explaining:

“We’re waiting for the Fed to see proper ‘bad news’ before they will really start cutting rates.”

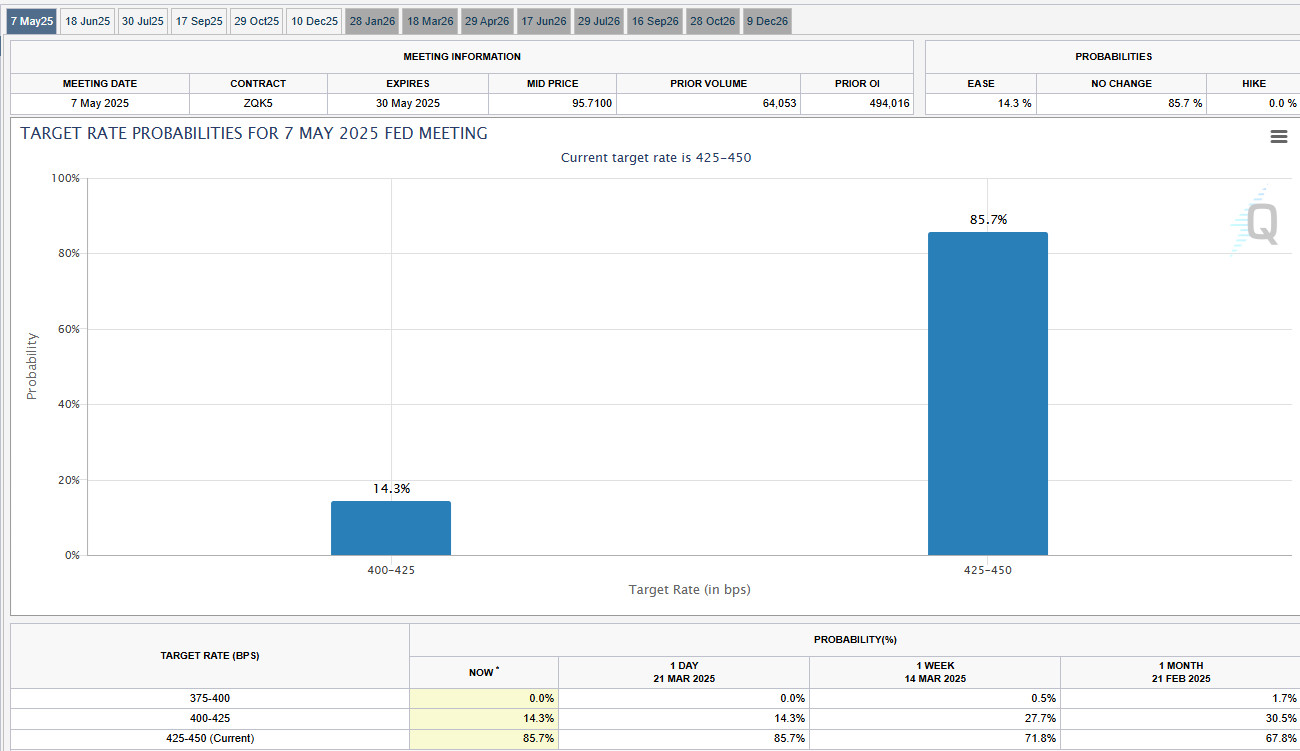

Markets are currently pricing in an 85% chance that the Fed will maintain current interest rates during the next Federal Open Market Committee (FOMC) meeting on May 7, based on estimates from the CME Group’s FedWatch tool.

Fed target interest rate probabilities. Source: CME Group’s FedWatch Tool

While the Federal Reserve continues emphasizing that inflationary pressures may be temporary, some analysts believe a stable economic outlook will eventually encourage investors. Iliya Kalchev, a dispatch analyst at Nexo, shared his perspective:

“Markets may now expect upcoming economic data with greater confidence. Cooling inflation and stable economic conditions could further boost investor appetite, driving additional upside for Bitcoin and digital assets.”

Looking ahead, investors are keeping a close watch on key economic reports such as Consumer Confidence, Q4 GDP, jobless claims, and next week’s crucial Personal Consumption Expenditures (PCE) inflation release. These data points will provide further insights into the likelihood of future rate cuts and their timeline.

Related: Crypto Debanking Fears May Persist Until January 2026, Says Caitlin Long

What’s Next for Crypto and Traditional Markets?

With trade policies and interest rates acting as major stressors, the next few weeks could be pivotal. If trade tensions ease and economic indicators signal a more relaxed approach from the Fed, both crypto and traditional markets could find renewed momentum.

However, in the short term, caution remains key. Investors are bracing for potential market swings until a clearer path emerges on trade and monetary policy. Staying informed on critical economic data and policy decisions will be essential in navigating this uncertain landscape.

Magazine: SEC’s Stance on Crypto Leaves Unanswered Questions

Would you bet on a crypto rebound post-April, or is the market still in for a bumpy ride? Let’s discuss! 🚀