Crypto ETFs Kick Off 2025 Strong Despite Year-End Lows

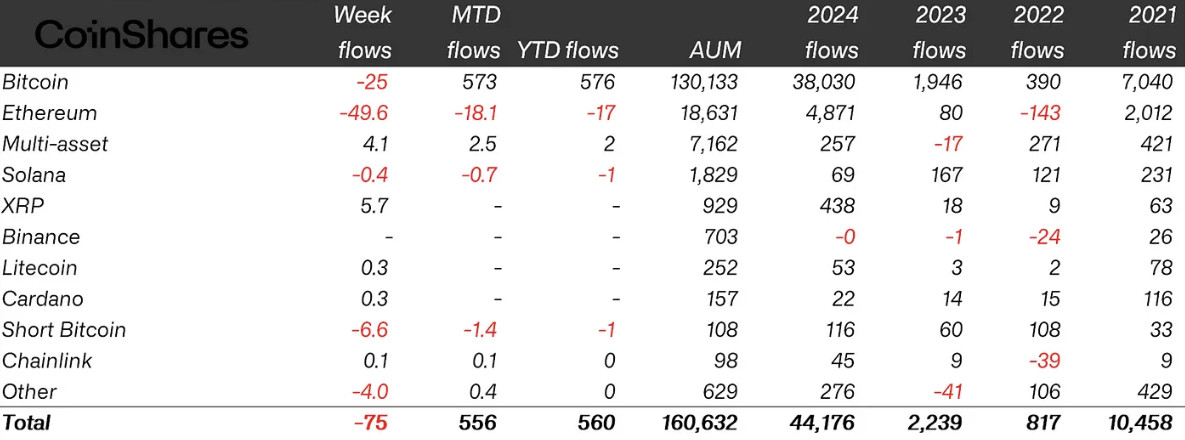

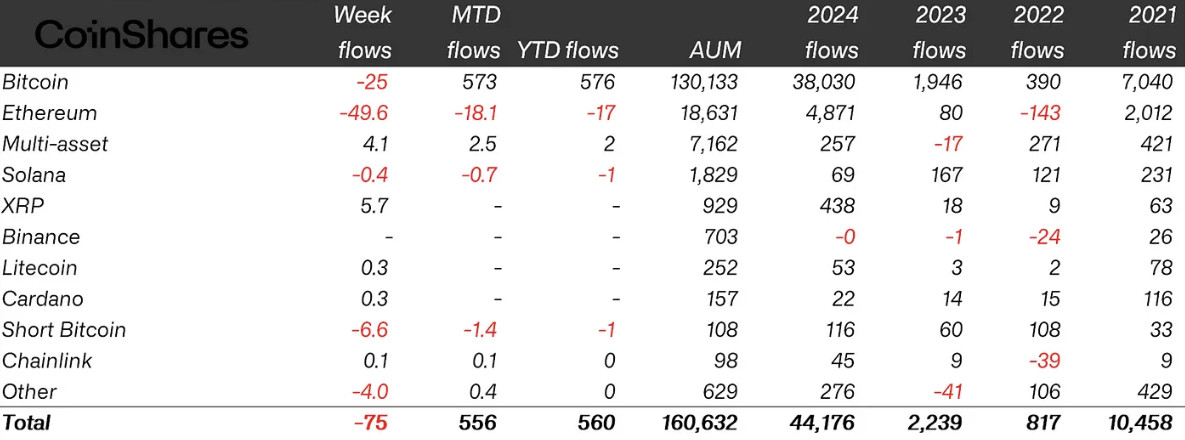

The new year has brought fresh optimism for cryptocurrency exchange-traded products (ETPs), with a strong start to 2025. In just the first three days of the year, crypto ETPs recorded a notable $585 million in inflows. However, this rally wasn’t enough to erase the selling pressure seen at the tail end of 2024, resulting in a net outflow of $75 million during the last trading week of the year, according to a recent report by CoinShares.

Despite this brief dip, 2024 went down as a historic year for crypto ETFs, with record-breaking inflows of $44.2 billion—an astounding 320% jump from the previous peak of $10.5 billion set in 2021. Driving this unprecedented surge was the much-anticipated launch of spot Bitcoin ETFs in the United States.

Bitcoin Leads the ETF Charge

Bitcoin (BTC) remained the undisputed leader in the crypto ETF space throughout 2024. BTC-based ETPs amassed a staggering $38 billion in inflows, accounting for 29% of Bitcoin’s total assets under management (AUM), which stood at $130 billion.

Ether (ETH)-backed ETPs also saw renewed investor confidence, especially in the latter half of 2024, pushing total inflows to $4.8 billion. This accounted for 26% of all Ethereum’s AUM, which reached $18.6 billion by year-end.

Investments, CoinShares, Ethereum ETF, Bitcoin ETF

Investments, CoinShares, Ethereum ETF, Bitcoin ETF

Adding to the diversity of crypto investment products, XRP (XRP)-based ETPs attracted $438 million in inflows, while multi-asset crypto ETPs secured $257 million. Altogether, crypto ETPs ended 2024 with a total AUM of $160.6 billion—a telling sign of growing institutional and retail interest.

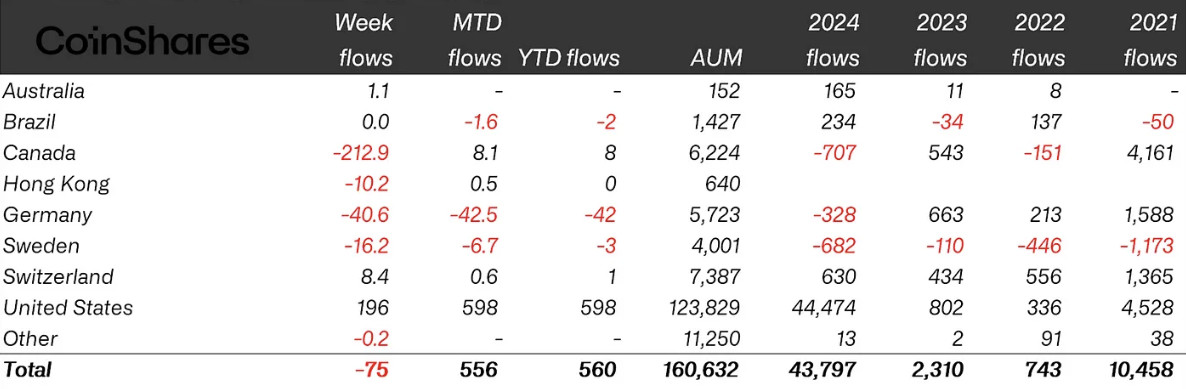

United States Drives Demand, While Canada Offloads Crypto ETPs

If 2024 proved anything, it was that the United States emerged as the leading buyer of crypto ETFs, contributing a massive $44.5 billion in inflows. However, not all countries mirrored this bullish sentiment.

Canada took the top spot as the largest seller of crypto ETPs, recording $707 million in outflows in 2024. This selling trend wasn’t isolated to Canada—Sweden and Germany also saw significant declines, with outflows reaching $682 million and $328 million, respectively.

Investments, CoinShares, Ethereum ETF, Bitcoin ETF

Investments, CoinShares, Ethereum ETF, Bitcoin ETF

While outflows from Canada, Sweden, and Germany cast a shadow over regional performance, other countries showed remarkable resilience. Switzerland and Brazil, for instance, saw inflows of $630 million and $234 million, respectively, helping balance out some of the losses.

What’s Next for Crypto ETFs in 2025?

With a strong start to the year, many analysts are optimistic about what lies ahead for crypto ETPs. Factors such as growing institutional adoption, the potential launch of spot ETFs for altcoins, and macroeconomic trends will play a key role in shaping the market.

Will Bitcoin’s dominance continue, or will we see a surge in interest for Ethereum and other altcoin-based ETFs? Only time will tell, but one thing is clear—the appetite for crypto investment products is far from fading.

📌 Stay tuned as we track the evolving landscape of crypto ETFs and emerging investment trends in 2025!