Crypto Market Shake-up: Tether’s Battle, Altcoin Survival & MetaMask’s Big Move

The Heat is On: Tether Facing Political and Industry Pressures

The stablecoin industry has long been a battleground, but now, the fight has intensified. Competitors and politicians are allegedly working behind the scenes to dethrone Tether, the colossal stablecoin issuer behind USDT. With a market cap of over $142 billion—dwarfing Circle’s USDC at $56 billion—Tether continues to dominate.

However, according to CEO Paolo Ardoino, many rivals aren’t playing fair. In a recent statement, he accused competitors of attempting to “kill Tether” rather than focusing on innovation. Political pressure is mounting as well, notably with Tether’s exclusion from the EU’s Markets in Crypto-Assets (MiCA) regulatory framework.

But Tether isn’t retreating. Ardoino reaffirmed the company’s dedication to global financial inclusion, highlighting their reach of over 400 million users and quarter-on-quarter wallet growth of 35 million. Whether Tether can withstand these challenges remains to be seen, but its grip on the stablecoin market is undeniable.

Altcoin Season 2025? Not So Fast

The days of blanket altcoin rallies may be coming to an end. According to Ki Young Ju, CEO of CryptoQuant, “Most altcoins won’t make it” in the 2025 cycle. Gone are the days when every token pumped simply because the market was thriving.

Instead, only projects with robust fundamentals, consistent investor interest, and real revenue models will thrive. With 24% of the top 200 cryptocurrencies hitting one-year lows, market-wide capitulation could be on the horizon. Analysts warn that this correction may flush out overleveraged positions—perhaps a necessary purge before the next bull run.

Bybit Hack Continues: A $335 Million Money Laundering Spree

Remember the $1.4 billion Bybit hack? The perpetrator is still on the move.

Blockchain analysts have been tracking the stolen funds, and so far, over $335 million has been laundered. In just 24 hours, 45,900 ETH (worth $113 million) was shuffled around. The hacker still holds around 363,900 ETH ($900 million), meaning this story is far from over.

This breach marks one of the biggest hacks in crypto history, shaking investor confidence and renewing concerns about security lapses in the industry.

US Lawmakers Push to Repeal “Unfair” Crypto Tax Rules

The crypto tax debate is heating up in Washington. The IRS’s controversial “DeFi broker rule,” which would expand tax reporting obligations to decentralized platforms, has faced pushback from lawmakers.

The rule, set to take effect in 2027, mandates brokers to report detailed transaction data, including taxpayer identities, to the IRS. But critics argue that imposing such regulations on DeFi would stifle innovation and infringe on financial privacy.

Lawmakers in the House Ways and Means Committee have now moved forward with a resolution to repeal the rule, with a 26-16 vote. While this is a step in the right direction for crypto advocates, the battle is far from over.

MetaMask Expands Fiat Off-Ramps: A Game Changer for Crypto Accessibility

For those navigating the crypto-to-fiat landscape, MetaMask just made life easier.

The popular Ethereum-based wallet, in partnership with Transak, is expanding its fiat off-ramp feature to support 10 additional blockchains. Previously, users had to convert assets to ETH before cashing out, incurring extra steps and transaction fees. Now, that’s changing.

Supported networks include Arbitrum, Avalanche, Base, BNB Chain, Optimism, and more. Immediate off-ramp support includes ETH, BNB, and Polygon’s POL token, with more to follow.

“By expanding off-ramping capabilities with Transak, MetaMask is removing barriers between crypto and traditional currency,” said Lorenzo Santos, senior product manager at Consensys.

This move is expected to streamline crypto accessibility and encourage broader adoption.

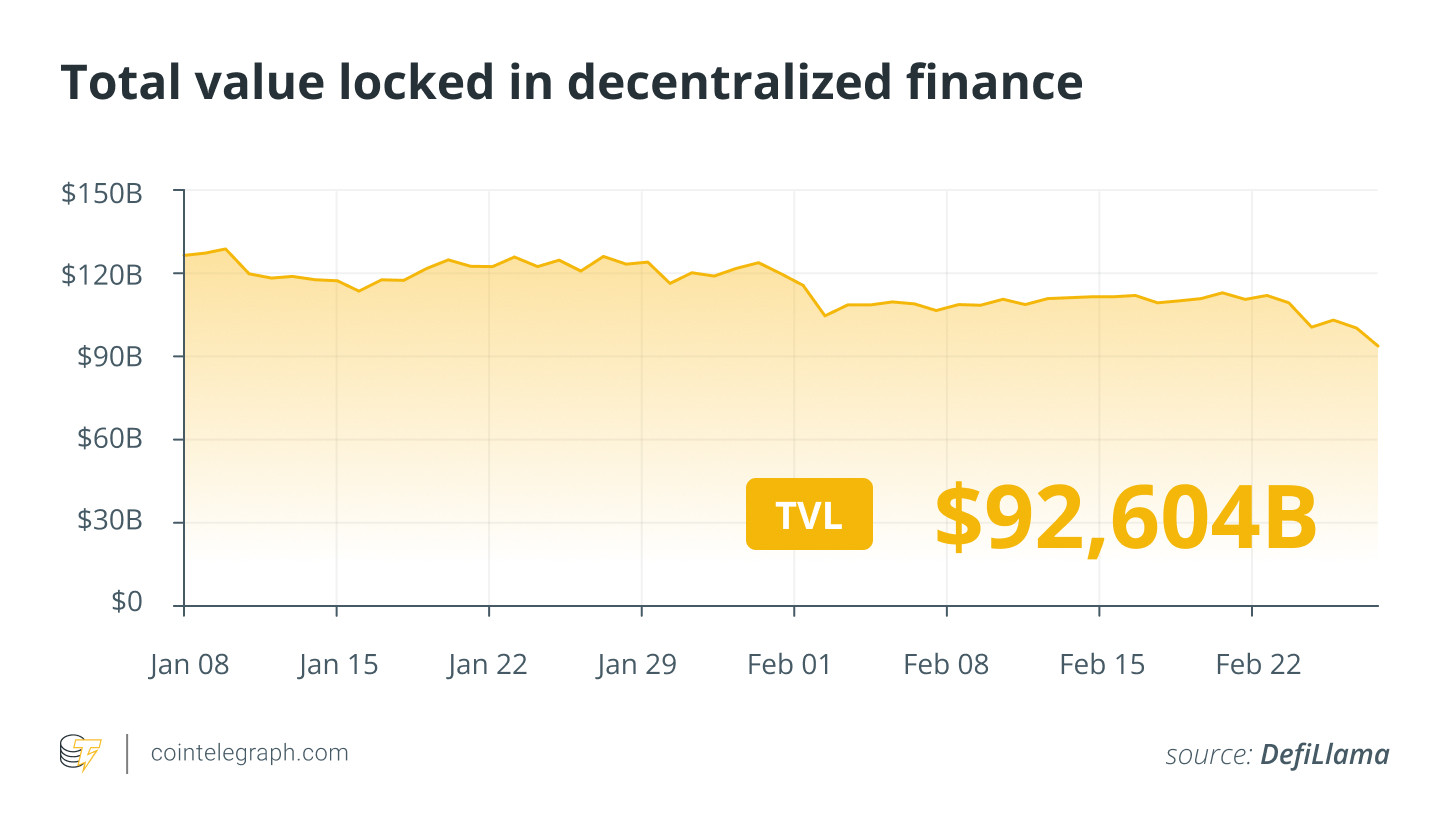

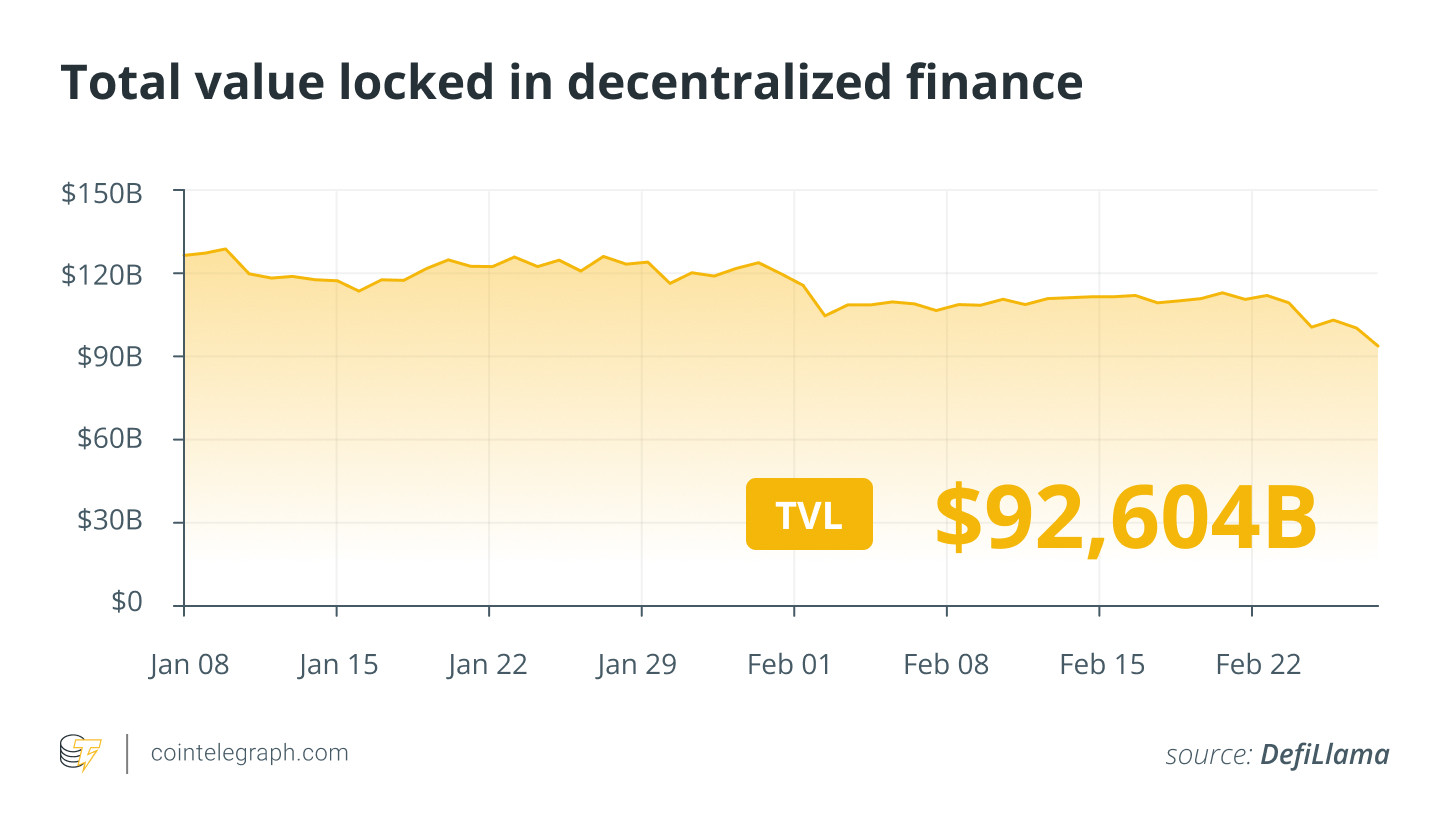

DeFi Market: A Tough Week for Top Players

It’s been a rough week for DeFi.

Data from Cointelegraph Markets Pro and TradingView shows that most top cryptocurrencies ended the week in the red. Among the biggest losers? Raydium’s RAY token, which plunged over 55%, followed by Lido DAO’s LDO token, which sank more than 34%.

Total Value Locked in DeFi

Total Value Locked in DeFi

Source: DeFiLlama

Despite the downturn, developments in regulation, security, and infrastructure continue to shape the future of decentralized finance.

Thanks for joining us for this week’s biggest crypto and DeFi stories. We’ll be back next Friday with more insights, market trends, and must-know updates!