Bitcoin Volatility Surges Amid Economic Uncertainty — What’s Next?

Bitcoin’s Wild Ride: Unpacking the Latest Market Swings

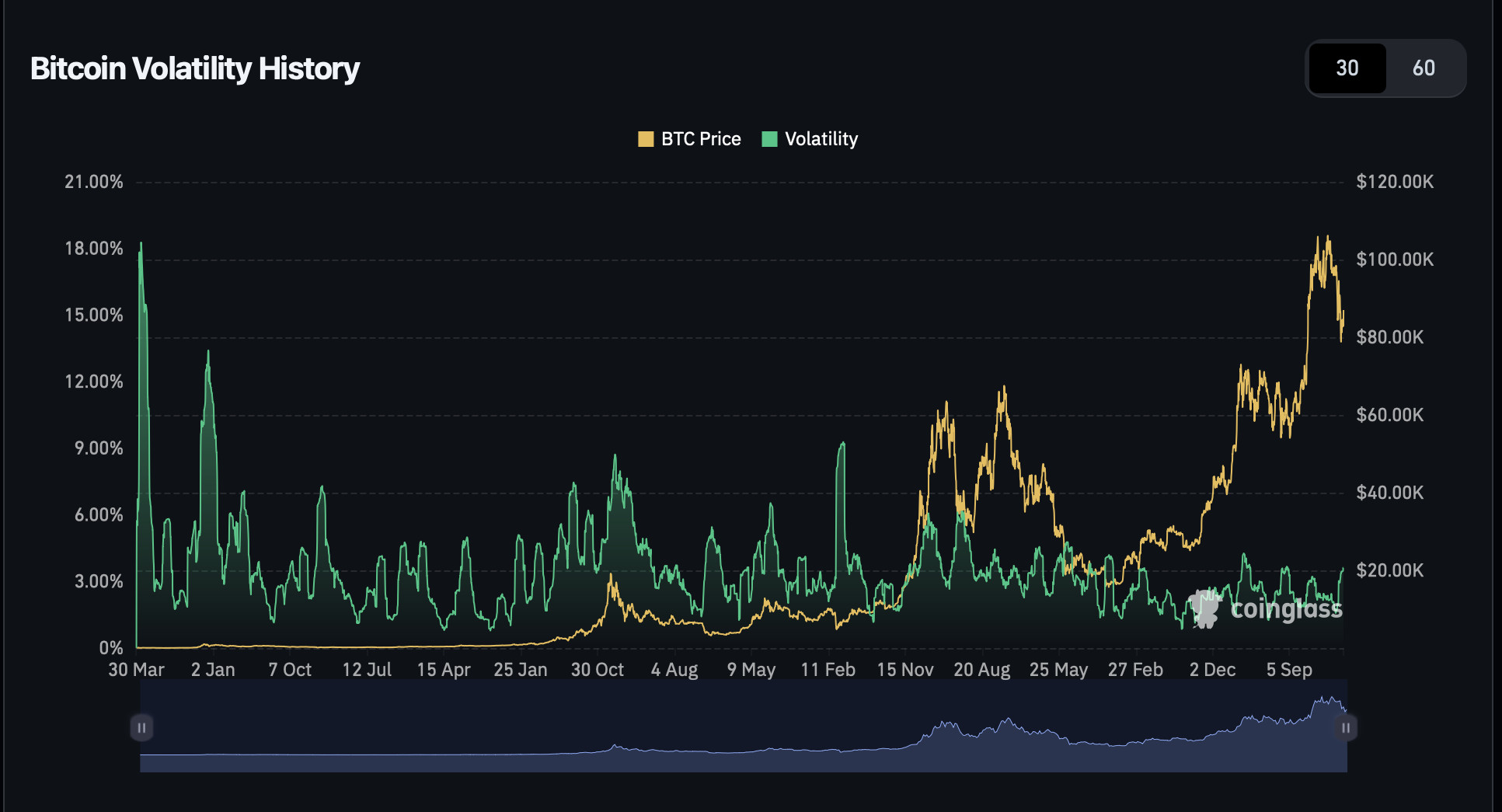

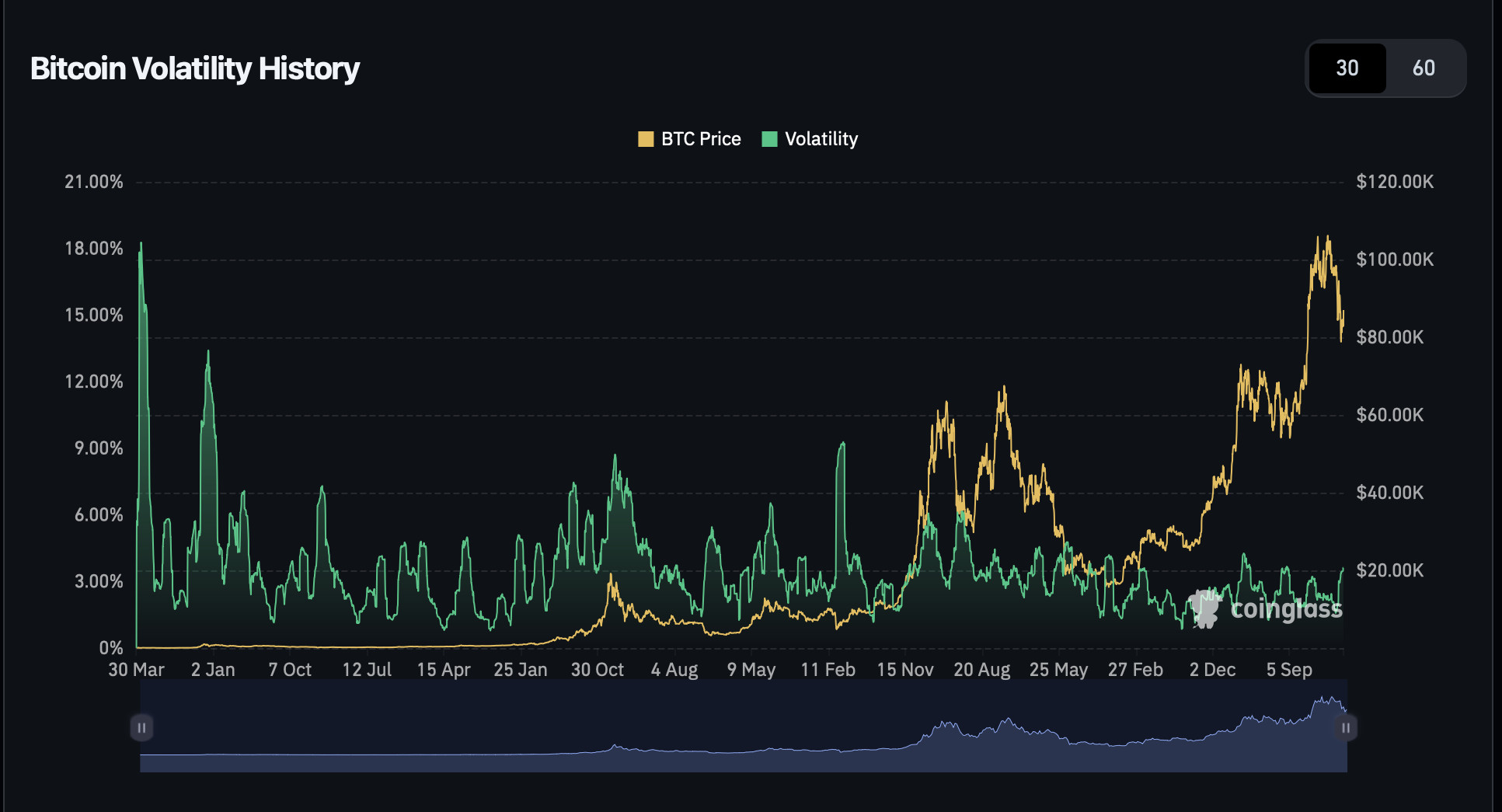

Bitcoin’s volatility spiked to 3.6% on March 19—the highest level seen since August 2024, according to CoinGlass. If you’ve been watching the markets lately, you know it’s been a rollercoaster ride. But what’s really driving these wild swings? Let’s dive into the key factors shaping Bitcoin’s price action.

Economic Turmoil and a Shifting Policy Landscape

Uldis Tearudklans, Chief Revenue Officer at UK-based crypto exchange Paybis, points to growing uncertainty in the U.S. economy as a major catalyst. One of the biggest shake-ups? The emergence of Elon Musk’s Department of Government Efficiency—a policy initiative aimed at slashing government spending.

“The policy landscape is becoming more complex with the emergence of Elon Musk’s Department of Government Efficiency,” says Tearudklans. “While the initiative to cut costs has bipartisan support, its broader economic consequences—particularly on employment and consumer demand—are hard to measure.”

So far, this new department has claimed to have saved the U.S. government $115 billion through workforce reductions, asset sales, and regulatory cuts. While that might sound like a win, such aggressive fiscal tightening could have unexpected ripple effects on both traditional markets and Bitcoin.

Bitcoin volatility history

Bitcoin volatility history

Bitcoin volatility from March 2013 to March 2025. Source: CoinGlass

The Fed Holds Steady — But For How Long?

On March 19, the Federal Open Market Committee decided to keep interest rates unchanged. While they hinted at two potential rate cuts in 2025, the uncertainty is keeping financial markets—and Bitcoin traders—on edge.

Tearudklans warns that if government spending continues to tighten while rates remain stable or gradually decline, we could see mismatches in fiscal policy that weaken the intended stimulative effects of future rate cuts. In short, the economic chess game remains unpredictable.

Bitcoin’s Price Swings Under Trump’s Influence

Bitcoin’s notorious volatility has been on full display since U.S. President Donald Trump took office in January 2025. Case in point: after BTC soared to an all-time high of $109,590 on January 20, it suffered a massive 30% retracement, dipping to $77,041 as of mid-March. However, demand appears to be stabilizing, with prices bouncing back to around $84,000 at the time of writing.

Tearudklans suggests that heightened volatility reflects traders pricing in vastly different economic outcomes—including the possibility of fiscal tightening even as interest rates hold steady or decline.

“This creates a complex feedback loop where reduced government spending could limit growth, potentially forcing the Fed to maintain a cautious stance or even delay future rate cuts.”

Trump’s Crypto Moves: A Game-Changer for Bitcoin?

In a move that caught the crypto world’s attention, Trump signed an executive order on March 7 establishing a strategic Bitcoin reserve and a digital asset stockpile for the U.S. He doubled down on his pro-Bitcoin stance at the 2025 Digital Asset Summit on March 20, where he boldly declared that the U.S. will be a “Bitcoin superpower”.

While Trump’s embrace of Bitcoin is fueling optimism, his tough rhetoric on tariffs and geopolitical tensions is also rattling financial markets—including crypto. The uncertainty leaves traders caught between bullish momentum and macroeconomic headwinds.

Looking Ahead: What’s Next for Bitcoin?

Right now, Bitcoin’s trajectory hinges on several moving parts:

- U.S. fiscal policy: Musk’s government efficiency measures could impact liquidity.

- The Federal Reserve’s next moves: Will rate cuts materialize in 2025?

- Geopolitical developments: Trump’s policies create both opportunities and risks for crypto.

Bitcoin has always thrived in uncertain times, and this era is no exception. Whether it continues its climb or faces another pullback, one thing’s for sure—its volatility isn’t going anywhere.

🔹 What’s your take on Bitcoin’s next move? Are we heading for new highs or another dip? Let us know in the comments!