Bitcoin’s Road to Recovery: Can It Reclaim $90K Amid Fed Policy Shifts?

A Market on Edge

Bitcoin has been on a bumpy ride, with a two-month decline sparking debates about whether the ongoing bull cycle is coming to an end. Some skeptics argue that the familiar four-year boom-and-bust cycle may not hold up this time. But despite the uncertainty, there’s a fresh glimmer of hope—Bitcoin could be gearing up for a rebound above the psychological $90,000 mark, thanks to easing inflation concerns in the U.S.

Markus Thielen, CEO of 10x Research, believes Bitcoin might experience a short-term relief rally. “We can see some counter-trend rally as prices are oversold, and there is a good chance that the Fed is mildly dovish,” he shared with Cointelegraph.

Thielen isn’t calling for an outright bull run just yet, though. Rather, he anticipates a period of consolidation in the broader market, with Bitcoin potentially climbing back toward the $90K territory.

Bitcoin daily RSI indicator. Source: 10x Research

Will the Fed Give Bitcoin a Boost?

Investor sentiment could get a lift from Federal Reserve Chair Jerome Powell’s recent remarks, where he hinted at a more cautious approach to monetary policy. Powell acknowledged growing uncertainties in the economy, stating that the Fed is likely to “remain on hold” for now.

This aligns with a recent X post by 10x Research, which pointed out Powell’s skepticism about the long-term inflationary effects of tariffs. He referenced a similar situation in 2019, when tariff-driven inflation proved to be short-lived, leading the Fed to cut rates three times.

The big question now is: how will today’s Federal Open Market Committee (FOMC) meeting shape the policy outlook? Investors are glued to their screens, looking for clues about interest rates and liquidity. The outcome could have a major impact on risk assets like Bitcoin.

Related: Crypto market’s biggest risks in 2025: US recession, circular crypto economy

Could the FOMC Meeting Be a Game Changer?

According to Iliya Kalchev, a research analyst at Nexo, any hints about the Fed wrapping up its quantitative tightening (QT) program could be hugely bullish for Bitcoin and other risk assets.

“If Chair Powell spreads his dovish wings, Bitcoin could take flight on renewed bullish momentum,” Kalchev told Cointelegraph.

That said, there’s still a risk that stubborn inflation or tighter financial conditions—such as prolonged high interest rates—could put a ceiling on Bitcoin’s upside.

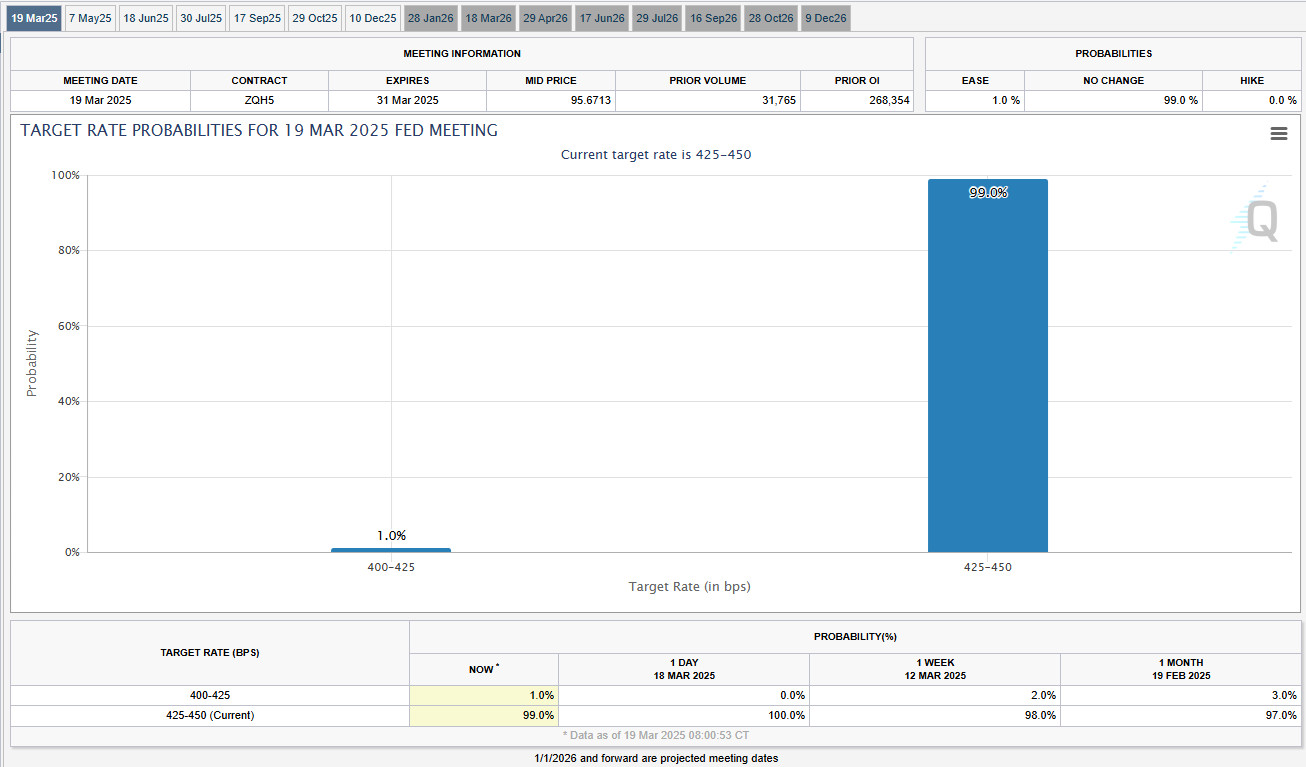

Fed target interest rate probabilities. Source: CME Group’s FedWatch tool

According to the latest data from CME Group’s FedWatch tool, markets are currently assigning a 99% probability that the Fed will keep rates unchanged.

However, investor anxiety is running high. A recent Bank of America survey showed that fund managers have dramatically cut their exposure to U.S. stocks—by the largest margin on record—between February and March. That could signal broader concerns about a potential recession, which might weigh on Bitcoin’s price action.

Related: Rising $219B stablecoin supply signals mid-bull cycle, not market top

What’s Next for Bitcoin?

While Bitcoin’s recent downtrend has sparked concern, there are signs that it may not be the end of the road for this bull cycle. If inflation concerns continue to ease and the Fed signals a shift in monetary policy, Bitcoin could regain momentum.

But with so much riding on macroeconomic factors, traders and investors should expect heightened volatility. Keep an eye on the FOMC meeting and broader market sentiment—Bitcoin’s next move may hinge on these critical developments.

One thing’s for sure: in the world of crypto, surprises are always just around the corner. 🚀