Bitcoin’s $87K Target: A Breakout on the Horizon?

Bitcoin is setting up for a massive breakout, with analysts eyeing an $87,000 price target in early 2025. But for now, BTC remains locked beneath a critical resistance level. Will it break through soon, or is more patience required? Let’s dive into the latest technical analysis and expert insights!

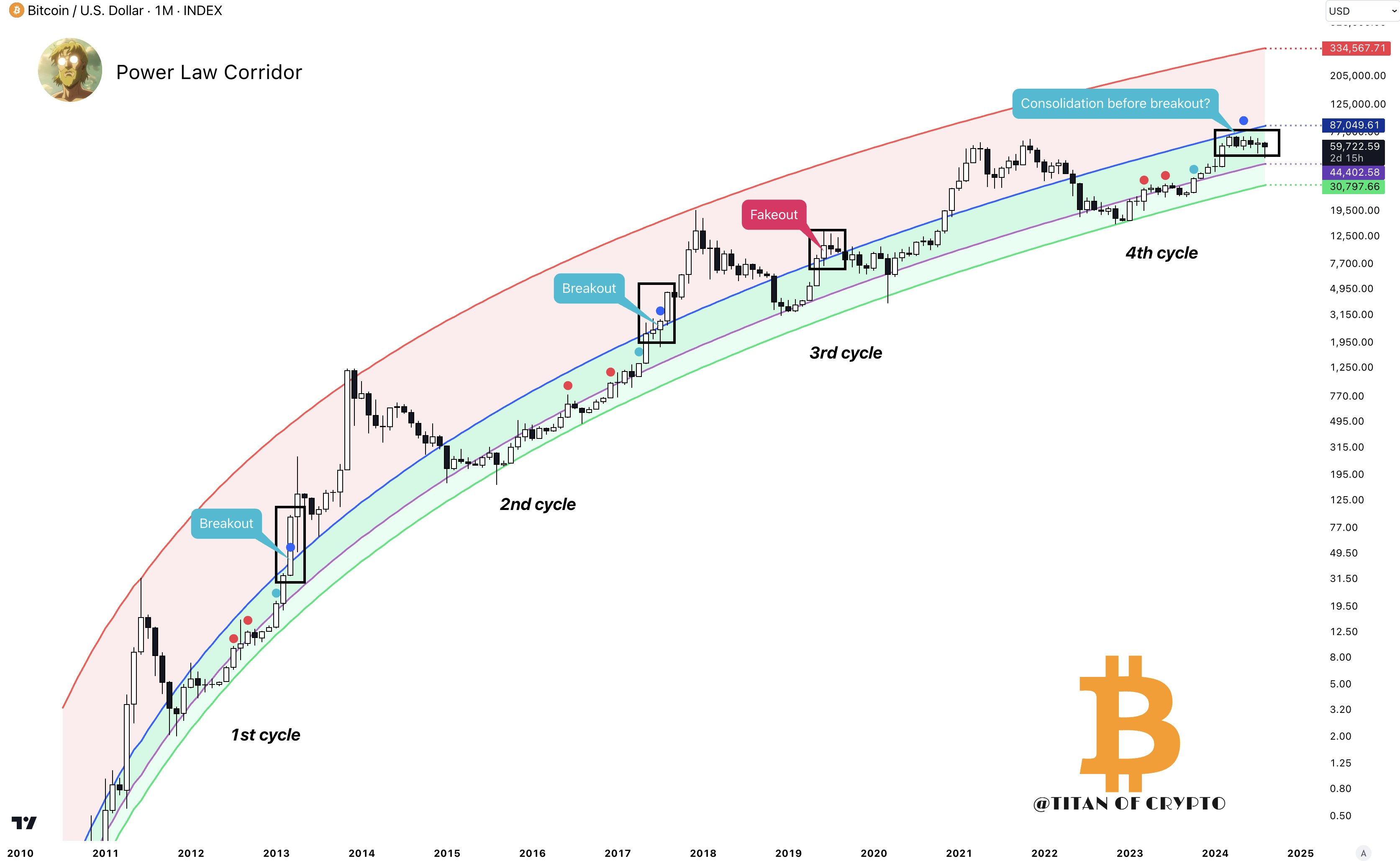

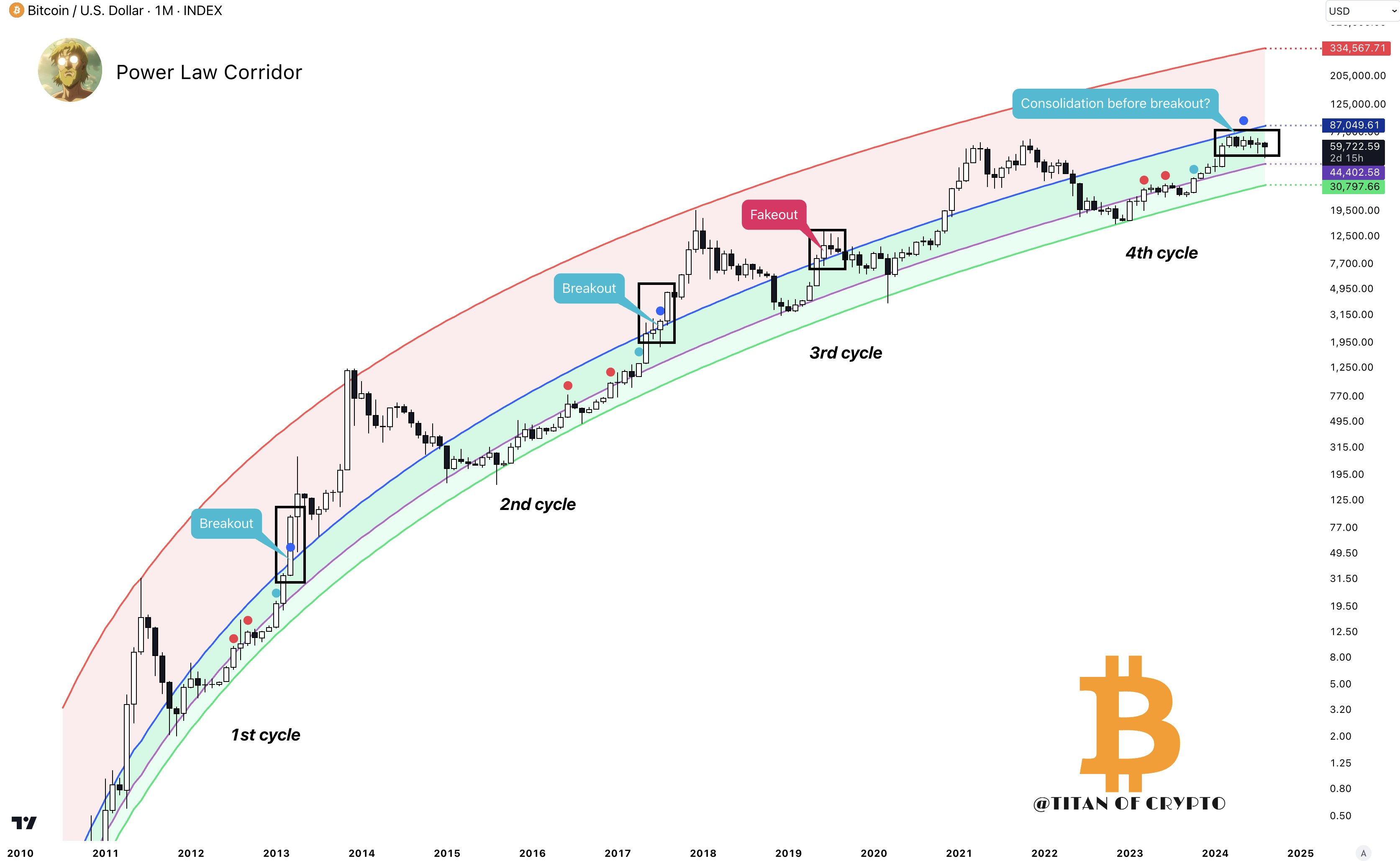

The Road to $87,000: A Power Law Prediction

According to the power law corridor, Bitcoin remains on track to reach $87,000 by early 2025. This model analyzes BTC’s long-term price movements, estimating future valuations based on historical trends.

Popular analyst Titan of Crypto recently emphasized this bullish outlook in an X post, suggesting that BTC is gearing up for a major move:

“Bitcoin $87,000 Blue Line Target. BTC seems to be consolidating, preparing to target the blue line of the Power Law Corridor.”

BTC/USD, power law corridor. Source: Titan of Crypto

The power law corridor isn’t the only technical indicator pointing to a breakout. Trader Tardigrade also highlighted Bitcoin’s strength, specifically referencing the Gaussian Channel—a tool used to analyze long-term price trends.

In an X post, the analyst noted:

“Bitcoin has been supported by Gaussian Channel since Jan 2023. After leaving the lower channel, a Massive Bull Run follows.”

Bitcoin, Gaussian Channel. Source: Trader Tardigrade

It’s clear that multiple indicators support the idea of an upcoming bull run, but BTC still has some hurdles to clear before it can fully capitalize on this momentum.

Related: Can Bitcoin get a green monthly close above $64.3K?

Breaking Through $59,600: The Immediate Hurdle

Before setting its sights on $87,000, Bitcoin must overcome a key short-term resistance level—$59,600.

Titan of Crypto stressed this crucial resistance in an X post, explaining that BTC’s next big move hinges on reclaiming this level:

“If BTC reclaims $59,600 and breaks through the cloud twist, the clouds would flip from resistance to support. This might trigger an upward move.”

BTC/USD, 1-day chart. Ichimoku Analysis. Source: Titan of Crypto

However, some analysts warn that this breakout may not come immediately. Market expert Elja Boom believes Bitcoin could remain in a consolidation phase until October, delaying any major price movement.

In an X post, he stated:

“No signs of breakout yet. Consolidation could happen till October before breakout. I’m confident of a breakout in Q4 but before that, there’ll be some more choppiness!”

Bitcoin bull flag, breakout Q4. Source: Elja Boom

What This Means for Bitcoin Traders

While BTC’s long-term trajectory appears bullish, traders should brace for potential short-term volatility. Bitcoin may continue to consolidate below $59,600 before making its next big move.

For those looking to enter the market, keeping an eye on Bitcoin’s interaction with key resistance levels—especially $59,600—will be crucial. A confirmed breakout could pave the way for further upside, whereas prolonged consolidation could test investors’ patience.

Related: $3K Ethereum price breakout likely delayed until October

Disclaimer: This article is for informational purposes only and does not constitute financial advice. All investments carry risks, and readers should conduct their own research before making trading decisions.