Bitcoin’s Price Action: A Storm Before the Surge?

Bitcoin Hits a Low Not Seen in Months

Bitcoin recently closed at $80,688 on March 9, marking its weakest daily and weekly performance since November 2024. With the cryptocurrency dipping below its 200-day exponential moving average (200-D EMA) for the second time in just two weeks, market sentiment is feeling the strain.

Bitcoin 1-day chart

Bitcoin 1-day chart

Bitcoin 1-day chart. Source: Cointelegraph/TradingView

To make matters worse, the Crypto Fear & Greed Index shows continued “extreme fear.” But despite the pessimism, some models still paint an optimistic picture for Bitcoin’s price movement in 2025.

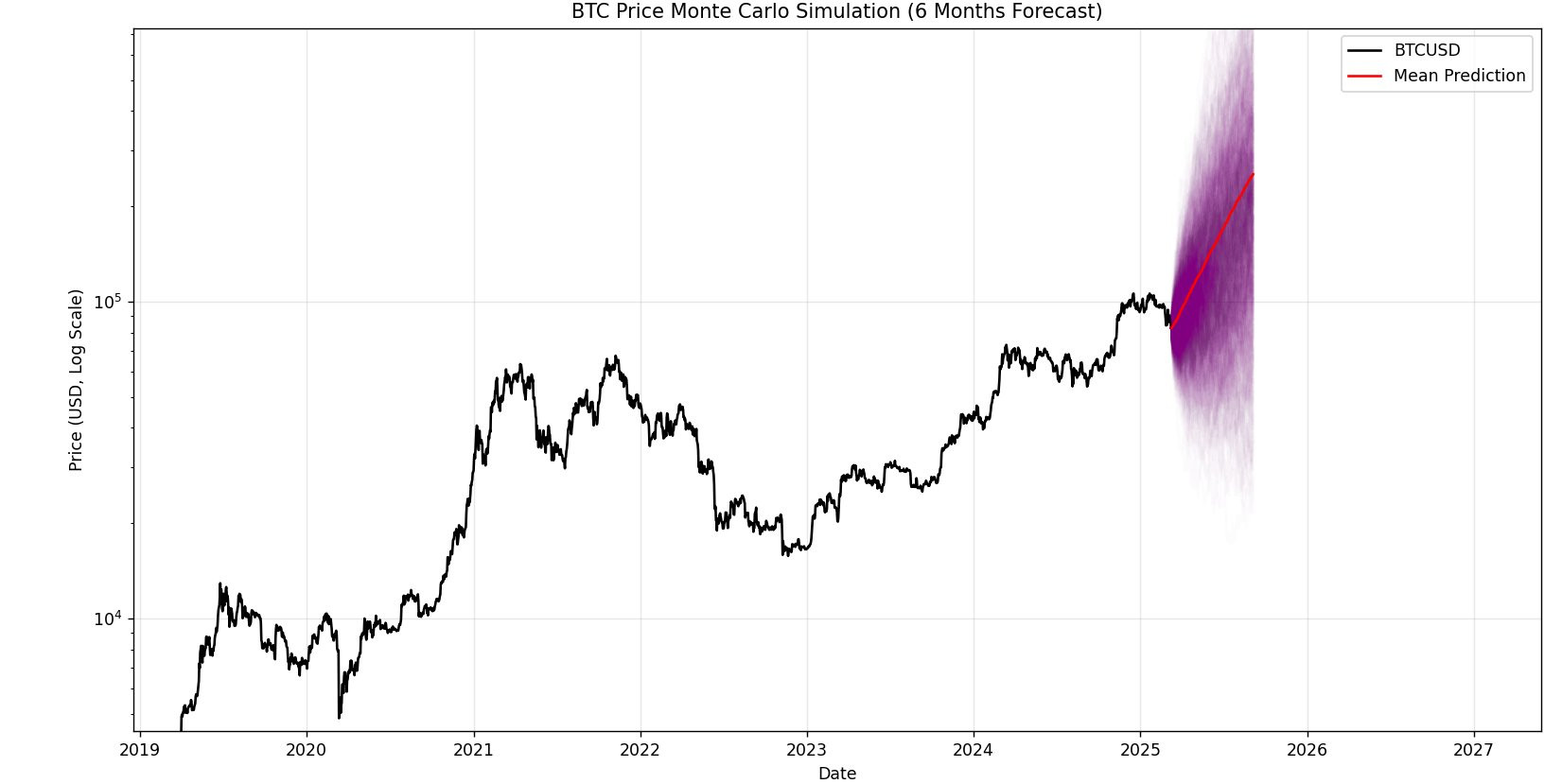

Monte Carlo Model Predicts an 800% Bitcoin Surge

Crypto researcher Mark Quant recently ran a Monte Carlo simulation to predict Bitcoin’s price action over the next six months. This statistical model, often used to assess risk and simulate different scenarios, suggests that Bitcoin could be in for a massive price increase.

Bitcoin Monte Carlo projections by Mark Quant

Bitcoin Monte Carlo projections by Mark Quant

Bitcoin Monte Carlo projections by Mark Quant. Source: X.com

What the Model Says

- Initial price point: $82,655

- Projected mean final price (September 2025): $258,445

- Possible range: As low as $51,430 (5th percentile) or as high as $713,000 (95th percentile)

This model assumes Bitcoin’s historical volatility while factoring in historical price trends. However, Monte Carlo simulations rely on geometric Brownian motion (GBM), which means randomness and market surprises are still at play.

Mark Quant also recently highlighted a correlation between the total crypto market cap and global liquidity trends, suggesting that we could see the market cap push above $4 trillion in Q2 2025.

CME Gap Brings More Volatility Into Play

Bitcoin saw a sharp drop of 6.38% over the weekend, leading to the creation of a CME futures gap. This phenomenon occurs when Bitcoin futures trading on the Chicago Mercantile Exchange (CME) closes on Friday and reopens at a significantly different price on Sunday evening.

Bitcoin CME gap

Bitcoin CME gap

Bitcoin CME gap. Source: Cointelegraph/TradingView

Why This Gap Matters

- Current CME gap: Between $83,000 and $86,000 (a $3,000 spread)

- Historical precedent: Bitcoin has filled the last seven CME gaps over the past four months

Mark Cullen, a well-known technical analyst, pointed out that the weekend’s gap may lead to a short squeeze before the U.S. markets open on March 10. He further warned:

“Lose the weekly open at ~80K and there is a gap down to low 70K’s.”

What’s Next for Bitcoin?

Bitcoin’s recent dip is undeniably concerning, but models like the Monte Carlo simulation suggest that brighter days may be ahead. However, traders should remain cautious as volatility remains high, and key technical levels could dictate the next significant move.

As always, it’s crucial to do your own research before making any investment decisions. The road ahead might be bumpy, but for seasoned Bitcoin holders, uncertainty has always been part of the ride.

Disclaimer: This article does not contain financial advice. All trading and investment decisions should be made with careful research and consideration of risks.