Bitcoin’s Hidden Strength: Realized Cap Hits Record $850 Billion

Bitcoin has just crossed a major milestone—its realized cap has reached an all-time high of $850 billion. This signals that more value is now stored within the Bitcoin network than ever before. But what does this really mean, and why is it important for Bitcoin’s future? Let’s break it down.

Bitcoin’s Value Surge: A Testament to Growth

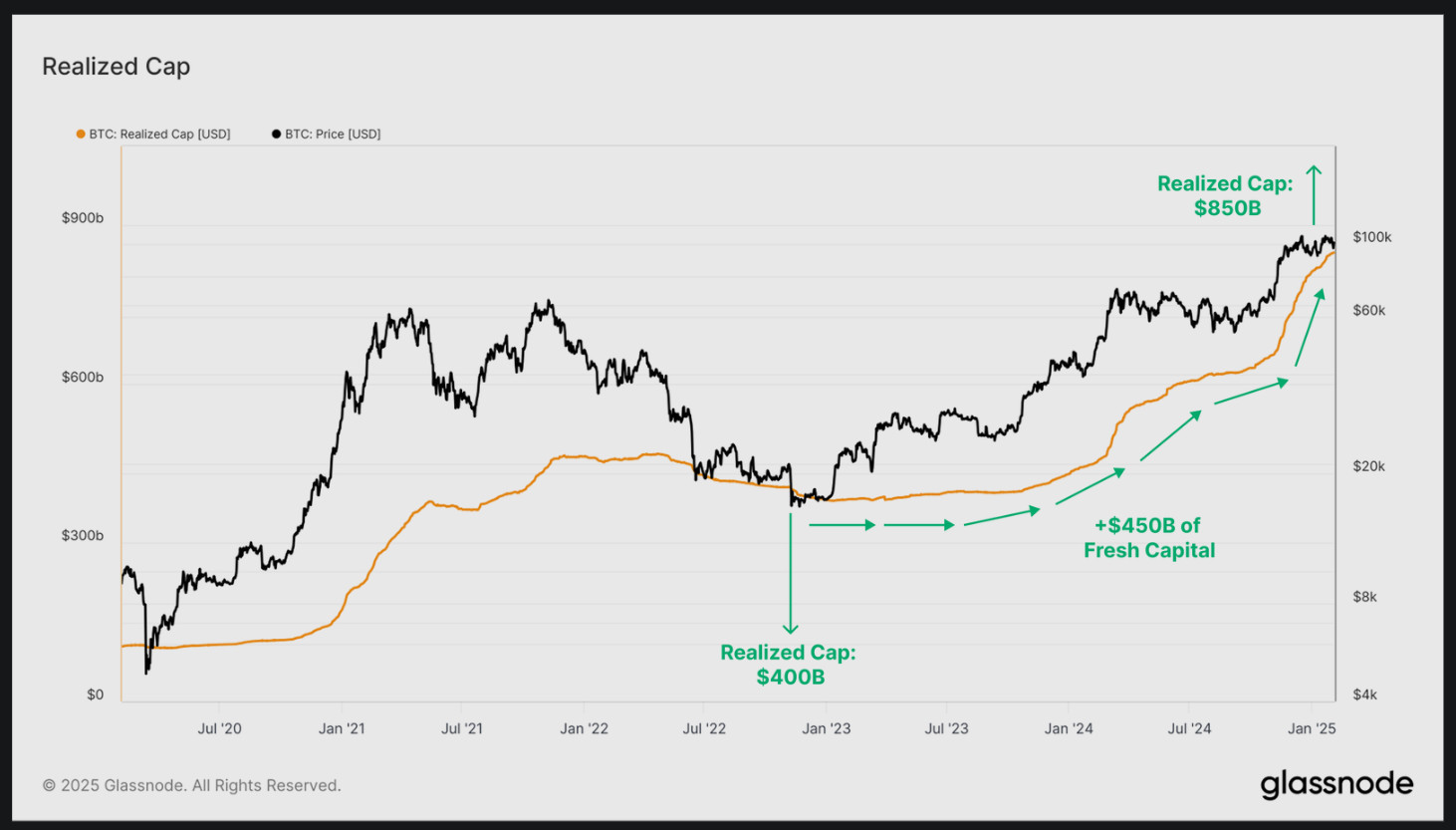

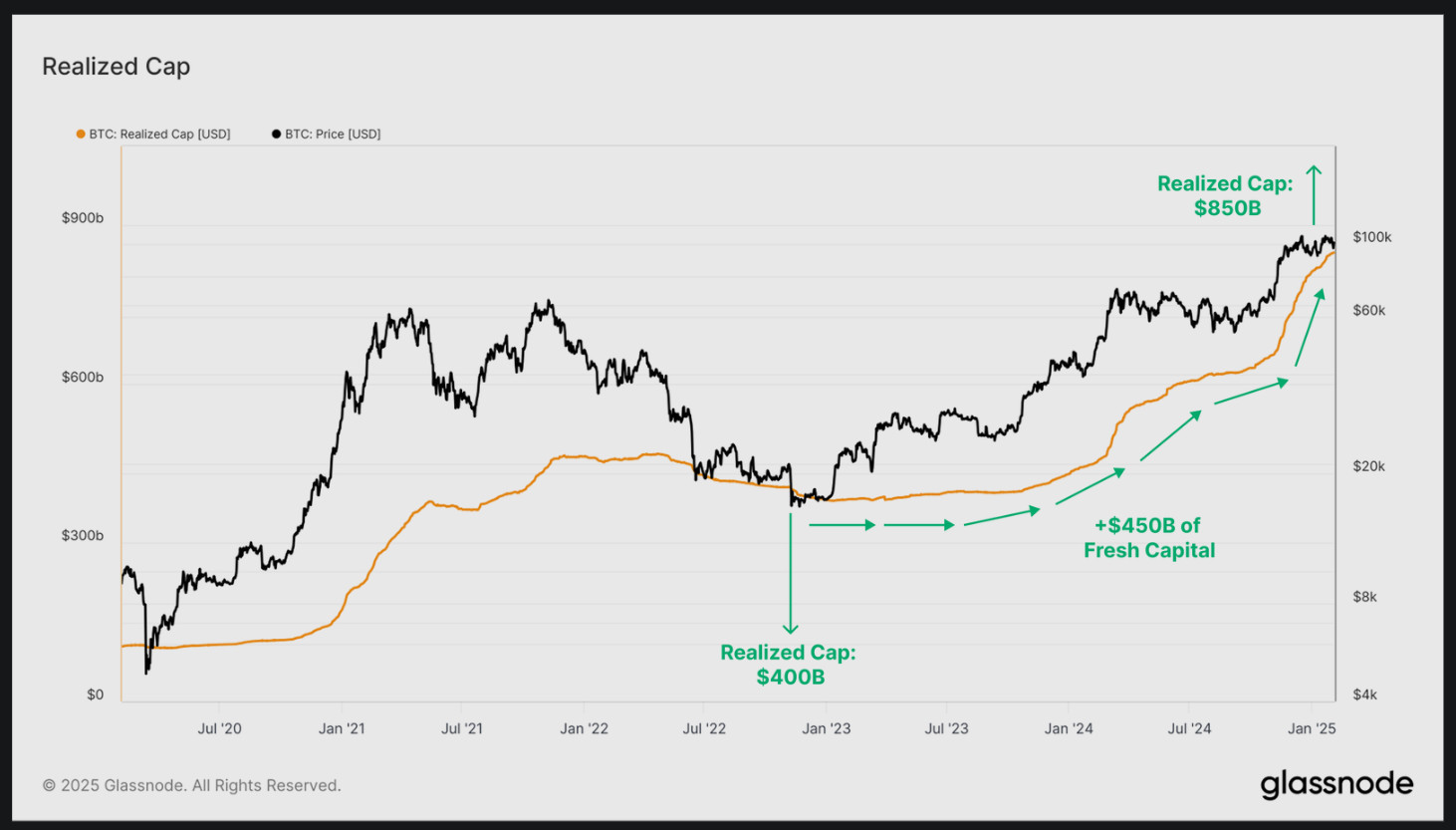

Bitcoin has seen a significant influx of capital since the crypto market hit its lowest point in 2022. Data from the blockchain analytics firm Glassnode reveals that Bitcoin’s realized cap—an indicator of Bitcoin’s actual stored value based on the last time each coin was moved—has more than doubled from $400 billion in November 2022 to an impressive $850 billion today.

“This reflects the aggregate ‘value stored’ in Bitcoin at around $850B, with each coin priced at the time it last transacted on-chain,” notes Glassnode.

Bitcoin realized cap chart (screenshot). Source: Glassnode

This means investors and institutions continue to trust Bitcoin as a store of value. The network has settled over $3 trillion in transactions within the past year, proving its growing role in global finance.

A Different Kind of Bitcoin Bull Market

Unlike previous bull markets, this cycle appears to be unique. Historically, Bitcoin sees a surge in demand, followed by a frenzy of retail investors jumping in. This time around, however, the flow of new capital looks different.

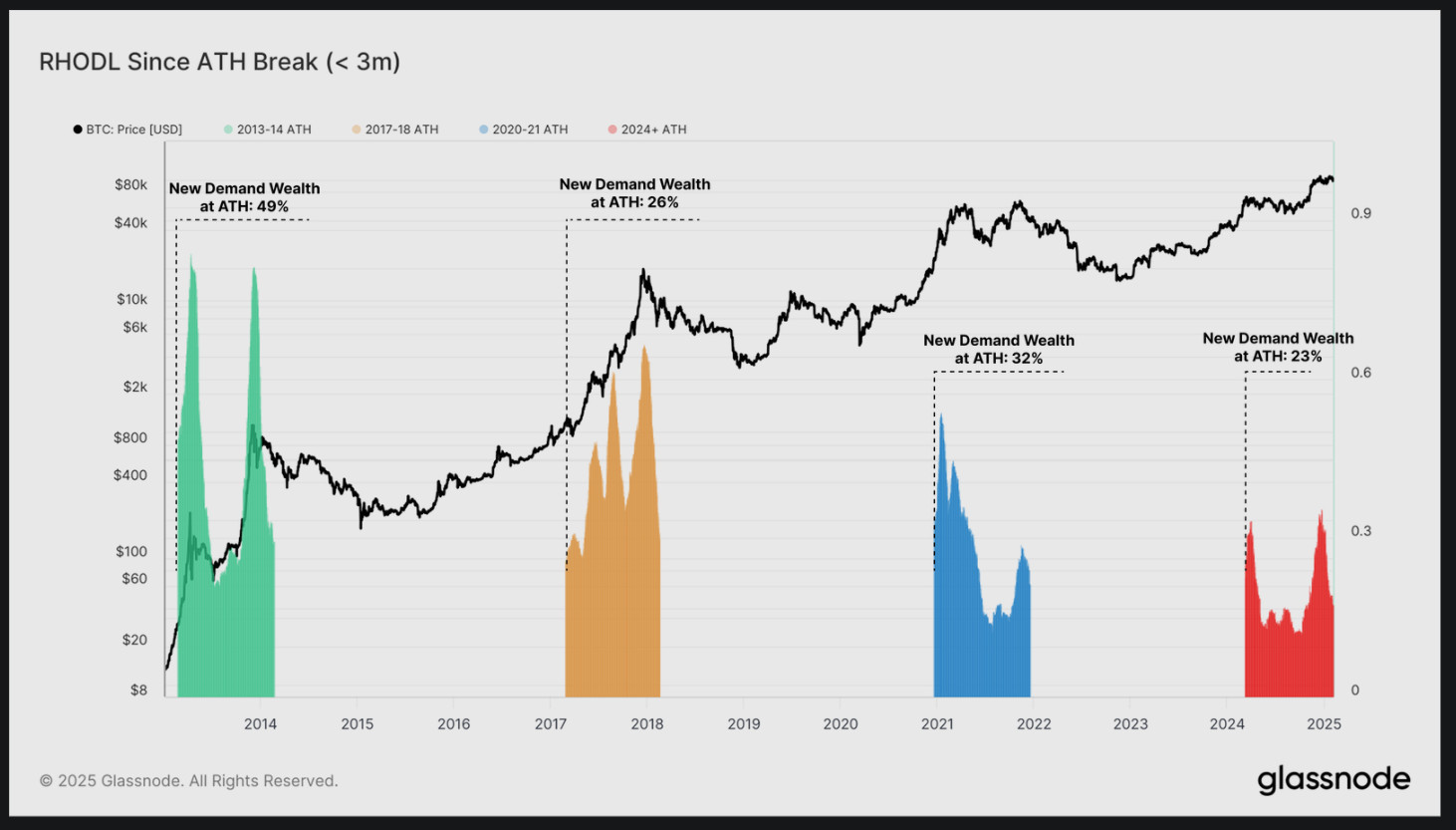

“Whilst new demand this cycle is meaningful, the wealth held in 3-month-old coins is much lower compared to previous cycles,” Glassnode highlights.

Typically, after Bitcoin reaches an all-time high (ATH), a full-blown retail-driven rally follows. This cycle, however, isn’t following the old playbook.

“Interestingly, all previous cycles had concluded approximately one year after the first ATH break, which highlights the atypical nature of our current cycle, which first reached a new ATH in March 2024.”

Bitcoin Realized Cap HODL Waves (RHODL) data. (screenshot). Source: Glassnode

With new demand appearing in bursts rather than a steady climb, this cycle could be driven by larger institutional investors rather than the typical retail crowd.

More Than Just a Speculative Asset

One recurring criticism of Bitcoin is that it lacks real utility. However, Glassnode’s data challenges this notion. With daily settlement volumes around $9 billion and a total of over $3 trillion transferred on-chain in the last year, it’s clear that Bitcoin is not just a speculative asset—it’s being used.

“Both the Realized Cap and the economic volumes settled by the Bitcoin network offer empirical evidence that Bitcoin both has ‘value’ and ‘utility’, challenging the assumption by critics that it has neither,” states Glassnode.

The Road Ahead

Bitcoin’s realized cap milestone paints a promising picture. More capital is flowing into the network, institutional players seem to be fueling demand, and Bitcoin continues to solidify its position as a legitimate store of value and transactional network.

However, it’s important to remember that Bitcoin remains a volatile asset. While the current trends indicate long-term growth, market cycles can be unpredictable.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making decisions.