Is the Next Altseason Here? Crypto Trends Signal a Shift

A New Altcoin Surge, But With a Twist

Crypto investors, hold onto your seats! According to Ki Young Ju, CEO of analytics platform CryptoQuant, the much-anticipated altseason has arrived—but this time, it’s not following the usual script. Instead of traders shifting profits from Bitcoin to altcoins, stablecoin holders are leading the charge.

On February 20, Young Ju noted in an X post that altcoin trading volume is soaring, now 2.7 times greater than Bitcoin’s. His take? BTC dominance is no longer the key indicator of altseason—trading volume is.

What’s Fueling This Altcoin Boom?

Traditionally, altcoins pump when Bitcoin investors take profits and rotate into smaller-cap assets. But Young Ju argues that this time, there’s no direct BTC-to-altcoin rotation happening. Instead, stablecoin holders—investors sitting on cash-equivalent crypto—are deploying their liquidity into select altcoins.

However, before aping in, take note: this isn’t a market-wide altseason. Young Ju warned that only a handful of assets are seeing big gains because the crypto market still lacks significant new liquidity inflows.

As of February 21, Bitcoin dominance stands at 58%, an increase from December’s 51.5% low, according to CoinStats. Historically, BTC dominance declines during altseasons—but this time, we’re witnessing a fragmented surge where only certain altcoins are outperforming.

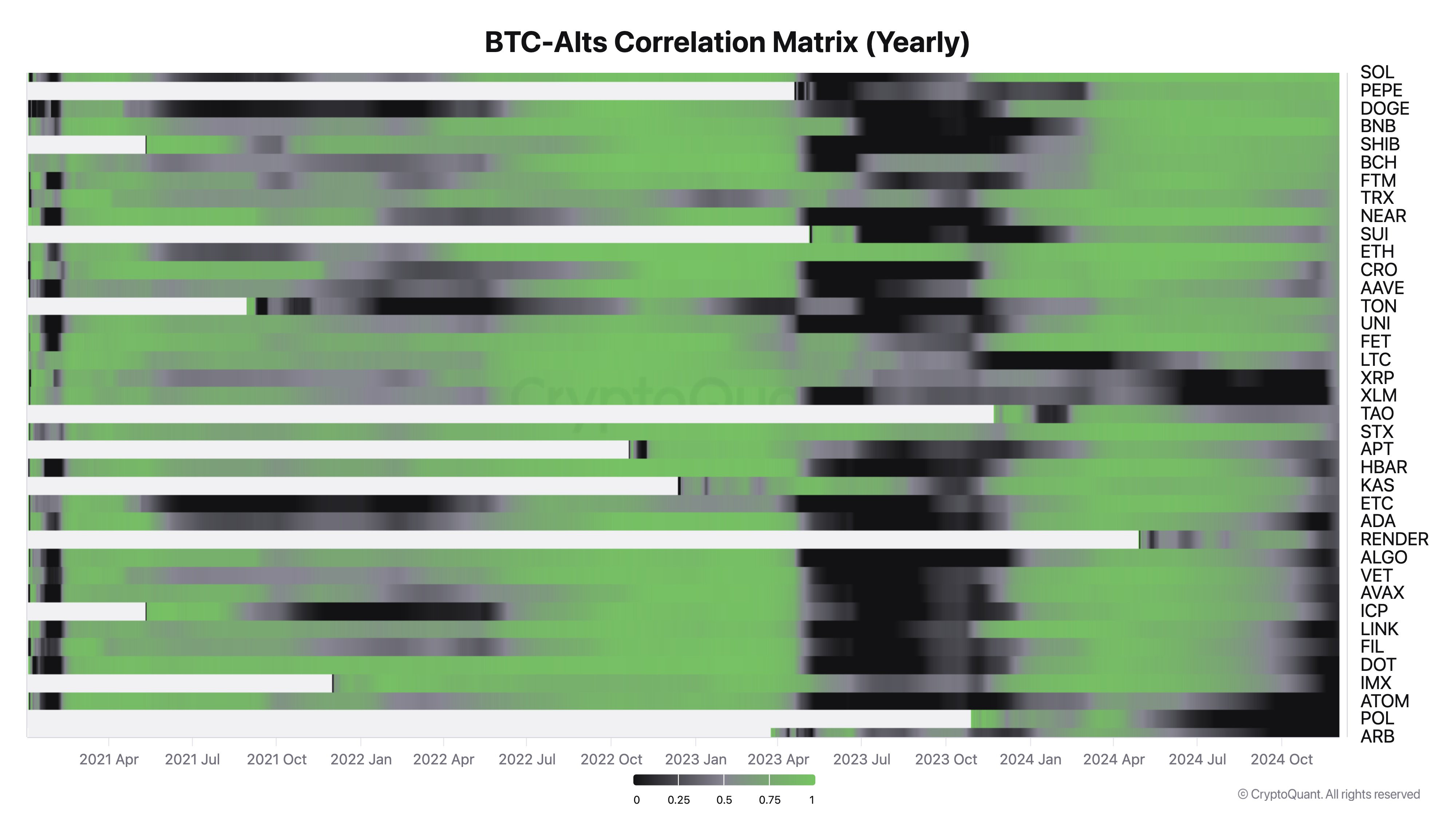

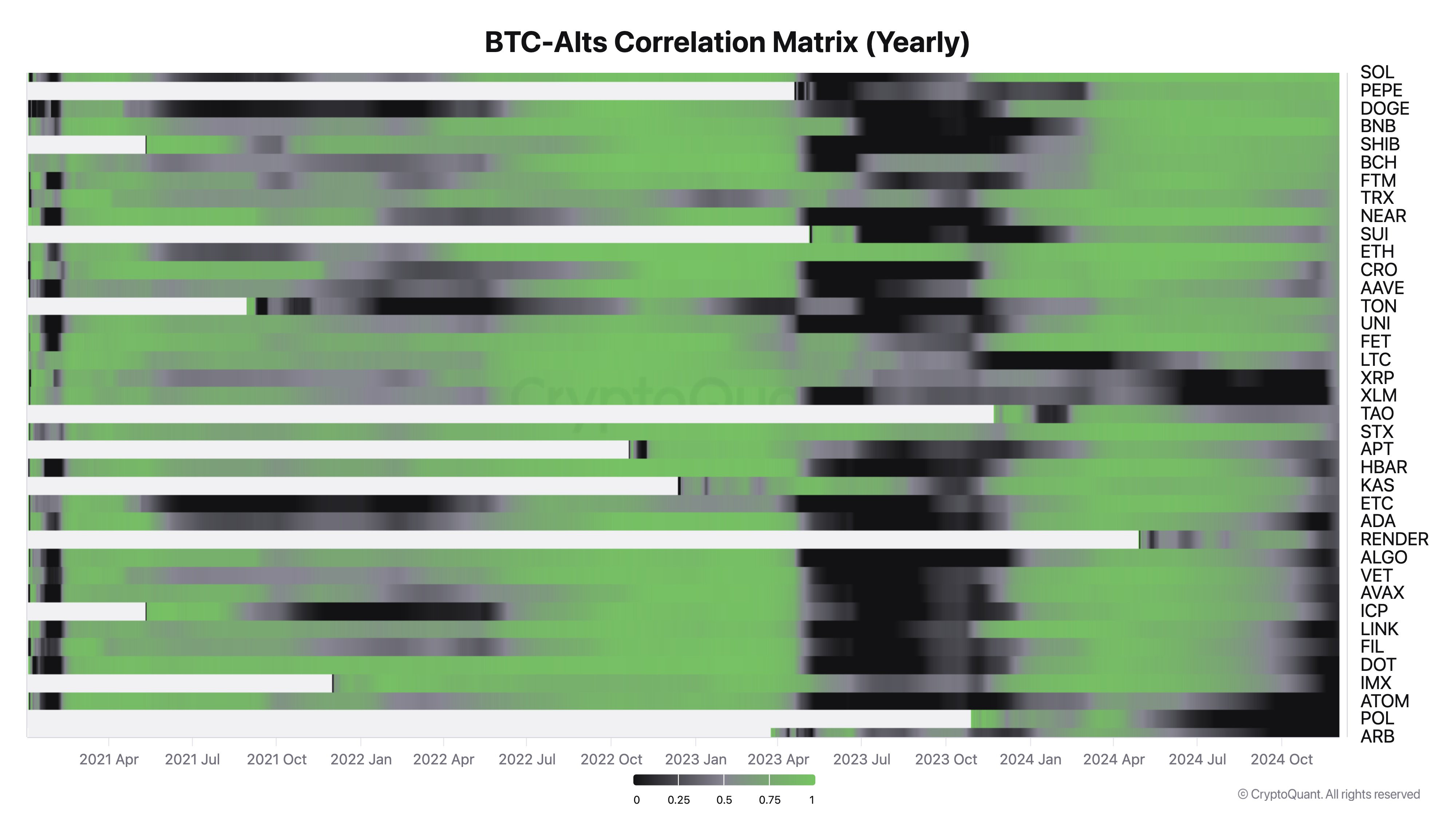

Bitcoin vs. Altcoins Correlation

Bitcoin vs. Altcoins Correlation

Bitcoin’s correlation with altcoins is breaking down. Source: Ki Young Ju

Stablecoins Shaping Market Dynamics

The shifting dynamics aren’t just about Bitcoin and alts—stablecoins are playing a bigger role than ever. The total stablecoin market cap has ballooned to $232 billion, fueled in part by increased demand for crypto assets following Donald Trump’s U.S. presidential election win, according to CoinGecko.

Institutional players are also paying attention. Banking giant Citi forecasts that the continued adoption of stablecoins will be a major driver of digital asset performance in 2025 (Citi Report). This could mean more capital deployment into altcoins as the market evolves.

However, not all altcoins are benefiting. Solana-based memecoins have been hit by rug pulls and insider trading schemes, leading to a mass exodus of users and declining capital inflows. This underscores the risks involved in an altseason dominated by selective tokens rather than broad-market euphoria (Cointelegraph Report).

Is Bitcoin Breaking Away From the Altcoin Market?

While altcoins are seeing selective gains, Bitcoin’s trajectory remains increasingly separated from the broader crypto market.

Institutional adoption continues to rise, with U.S. Bitcoin ETFs now holding over $100 billion worth of BTC (Cointelegraph Report). Meanwhile, public companies have amassed $60 billion in Bitcoin holdings, treating it as an inflation hedge (BitcoinTreasuries.NET).

Young Ju describes Bitcoin as building its own “paper-based Layer 2 ecosystem” through ETFs and institutional investment vehicles. In his words, Bitcoin’s deep integration with regulated markets makes “bridging to altcoins impossible”—suggesting that BTC may no longer drive altseasons the way it once did (X post).

What Comes Next?

Altseason isn’t dead, but it looks different this time around. Stablecoin liquidity is fueling selective altcoin moves, while Bitcoin is increasingly behaving like an independent macro asset.

For traders, the key takeaway is to be selective—not all altcoins will benefit from this evolving market structure. With institutional Bitcoin demand rising and stablecoins reshaping liquidity flow, understanding where the smart money is moving will be critical for navigating the coming months.

So, are we truly in an altseason? The signs are there, but it’s no free-for-all. This time, only the strongest contenders will thrive.

Related: Solana’s memecoin trust crisis: User activity drops 40%